SEARCH

RECENT POSTS

Categories

- Agriculture (28)

- Automobiles (18)

- Banking and Financial services (31)

- Consumer Markets (45)

- Defence (6)

- Ecommerce (19)

- Economy (66)

- Education (12)

- Engineering (6)

- Exports (21)

- Healthcare (23)

- India Inc. (8)

- Infrastructure (29)

- Manufacturing (25)

- Media and Entertainment (12)

- Micro, Small & Medium Enterprises (MSMEs) (15)

- Miscellaneous (30)

- Perspectives from India (33)

- Pharmaceuticals (4)

- Railways (4)

- Real Estate (16)

- Renewable Energy (17)

- Research and Development (8)

- Retail (1)

- Services (6)

- Startups (15)

- Technology (53)

- Textiles (6)

- Tourism (11)

- Trade (5)

India’s hand and power tools sector is set to unlock US$ 25 billion in exports

- Sep 29, 2025, 10:00

- Manufacturing

- IBEF

India is charting an ambitious course to become a global manufacturing powerhouse, driven by its vision of being a developed nation by 2047. This vision is not just aspirational, it is backed by bold policy initiatives, a young workforce, and a fast-evolving industrial base. The manufacturing sector contributes ~ 17% to the Gross Domestic Product (GDP) as of 2024. It is supported by robust physical and digital infrastructure which is expected to grow to 21% within seven years and ~ 27.3 million workers, underscoring its critical role in the country’s economic growth story.

Today, India stands at the threshold of its "golden age" of industrialisation, high merger and acquisition activity, encouraging government policies, capacity creation, and heavy investment from private equity and venture capital firms. Such an environment puts India at a vantage point not only to serve domestic demand but also lead in global supply chains.

Within this larger manufacturing blitz, the hand-and-power tools industry stands out with definite pluses. Tools usually would be the backbone of industrial work. They allow precision, efficiency, and productivity along the automotive, construction, electronics and aerospace sectors. Because of a huge global surge in the demand for tools, India has a chance to become a key supplier.

What are hand tools and power tools?

Tools are essential to every industry, from construction and manufacturing to automotive and home improvement. Broadly, they fall into two categories:

- Hand tools are non-motorised and rely on manual effort. Common examples include wrenches, pliers, screwdrivers, hammers, handsaws, and knives. They are affordable, versatile, and ideal for tasks that require precision and human control.

- Power tools are motorised and powered by electricity, batteries, hydraulics, or compressed air. Examples include drills, saws, grinders, and pneumatic tools. While they require high investment and upkeep, power tools deliver speed, scale, and automation, making them indispensable for modern manufacturing.

Maintaining high quality standards, Indian manufacturers already export hand tools to European markets. Leading companies like Groz Engineering, JK Files, Shiv Forgings, Gardex, and HR International dominate India’s tool exports. The top seven exporters account for only ~ 25% of India’s tool export value, reflecting an ecosystem dominated by thousands of small and medium enterprises (SMEs). To realise India’s ambitions, this industry must scale up and compete globally.

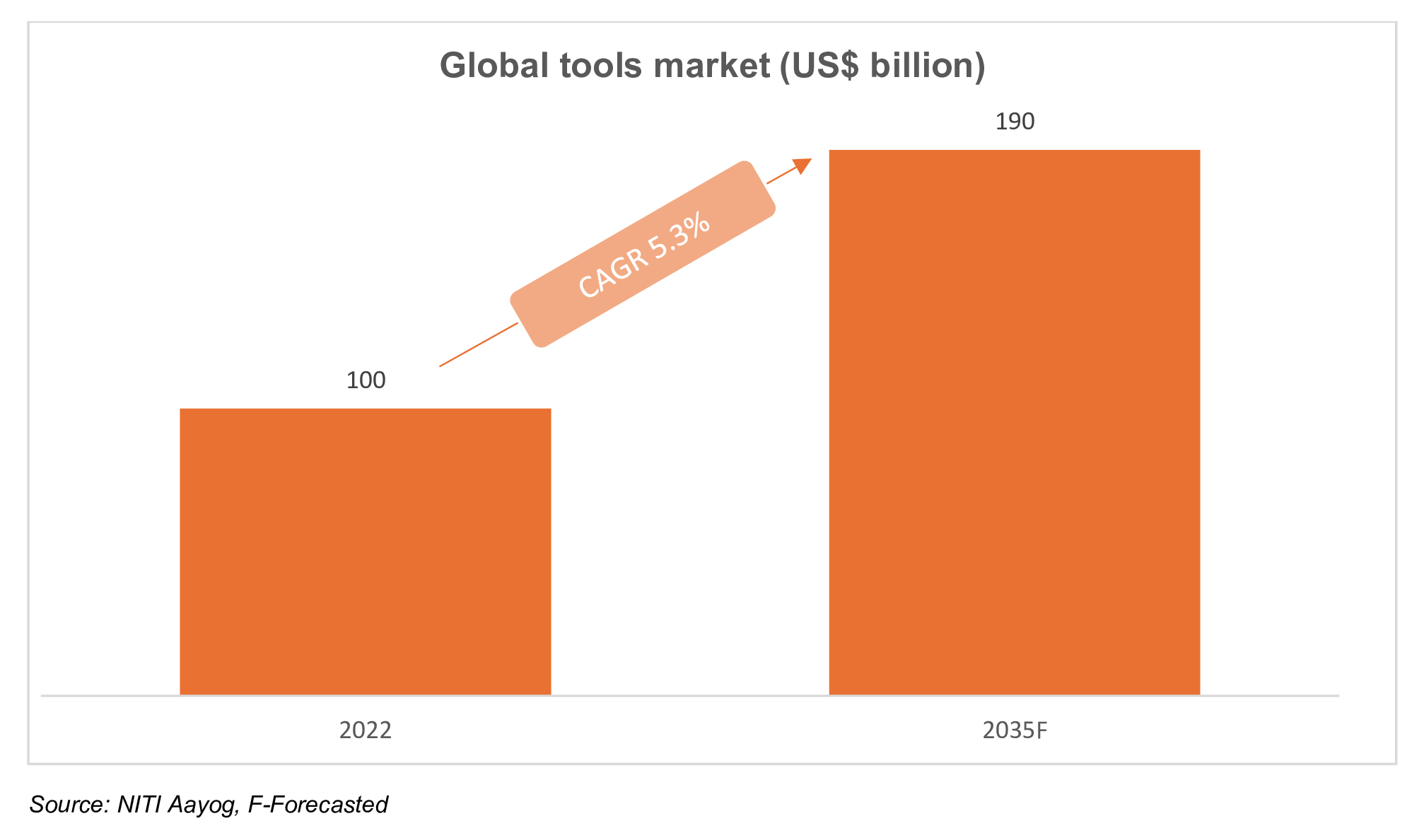

The global tools market – hand tools plus power tools was worth about Rs. 8,45,500 crore (US$ 100 billion) in 2022. Its compounded annual growth rate (CAGR) is projected at ~ 5.3% to reach ~ Rs. 16,06,450 crore (US$ 190 billion) by 2035.

Key trends include:

- Market segments: Power tools dominate the tools industry. In 2022, the power tools segment was valued at ~ Rs. 5,32,665 crore (US$ 63 billion) (70% of the total tools market) and is expected to reach Rs. 11,32,970 crore (US$ 134 billion) by 2035 (6% CAGR). The remaining Rs. 2,87,470 crore (US$ 34 billion) comprises hand tools at ~ 4.5% CAGR. Within these segments, tools like electric angle grinders, saws, and drills (in power tools), and hand saws, spanners, and wrenches (in hand tools) are among the largest traded products.

- Growth drivers: Industrialisation and rising disposable incomes are fuelling demand, along with a boom in Do-It-Yourself (DIY) activities. Over 70% of the power tools market is electric; cordless (battery-powered) tools are a fast-growing subsegment due to their mobility.

- Global supply chains: The hand tools industry is highly fragmented and decentralised. The top four global hand-tool companies hold ~ 20% of the market, and many firms operate local manufacturing clusters. For example, Apex Tool Group runs 20 factories across the US, Mexico, Germany, and Canada. By contrast, power tools are consolidated and capital-intensive. The top six power-tool names control ~ 70% of the market (e.g., Makita operates in seven countries; Hilti in four). Power-tool production tends to cluster in a few locations with sophisticated machinery, Research and Development (R&D), and centralised suppliers of motors, batteries, and electronics.

Trade patterns

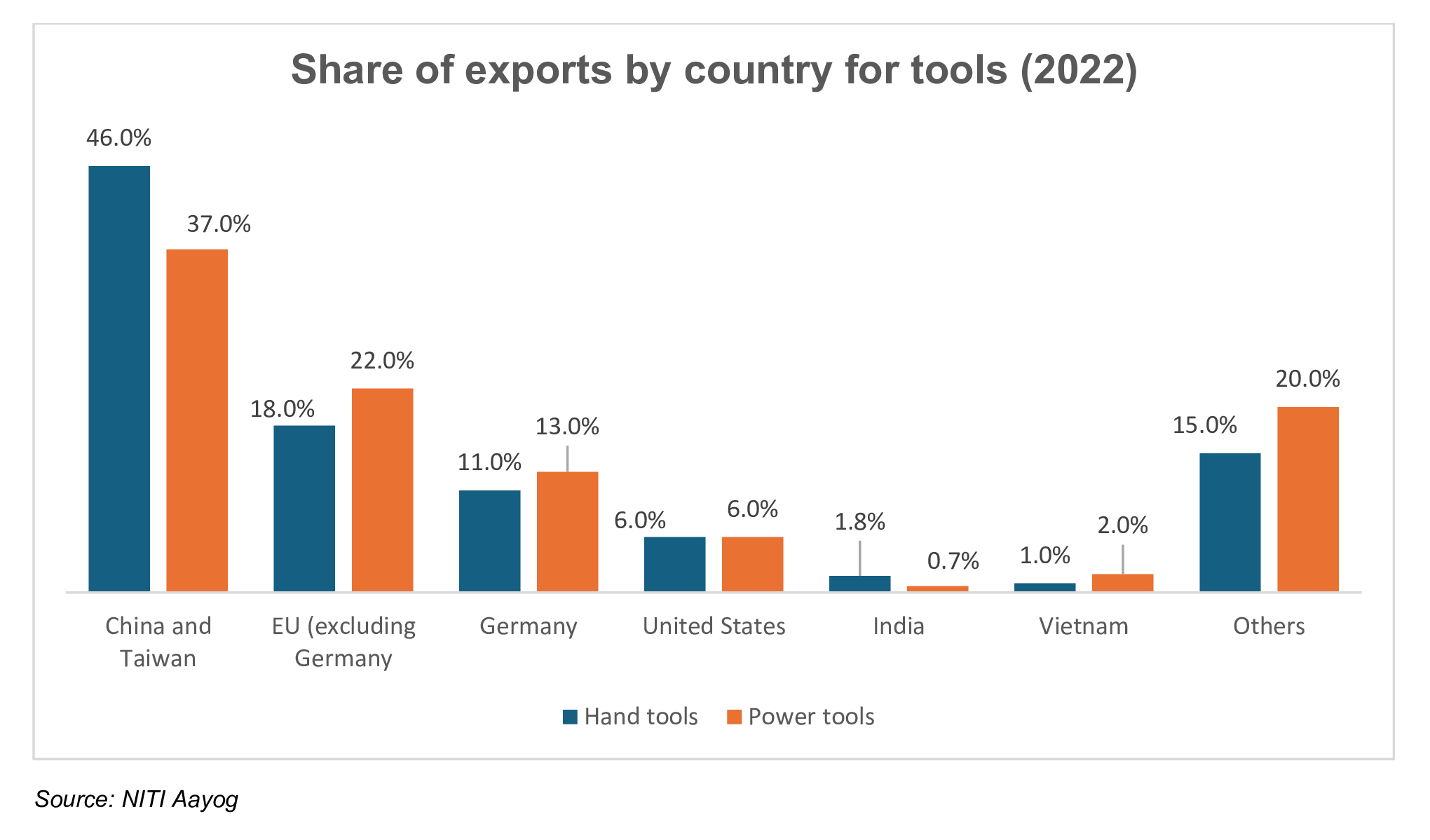

Worldwide, China and Taiwan are dominant exporters of tools. Together they supply ~ 46% of global hand tools exports and 37% of power tools exports. The European Union (excluding Germany) contributes ~ 18% of hand-tool exports and 22% of power-tool exports.

Major importers are the United States and the European Union, which together account for 55–60% of global tools imports. This heavy import demand in Western markets presents a significant growth opportunities for exporters.

These dynamics have set the stage for India to expand its share. However, India currently lags major players. In global exports, India accounts for ~1.8% of the hand tools market and 0.7% of the power tools market. This small base underscores India’s potential to grow in the face of shifting global supply chains.

India’s position

Within the global tools trade, India’s strengths and gaps vary by product:

- Hand tools: India has a strong niche in labour-intensive hand tools. For instance, India accounts for ~5% of the world’s spanners and wrenches exports. By contrast, India’s share of global handsaw exports is less than 1%. The domestic hand-tool industry is built on cost-effective labour (~ Rs. 84.70 (US$ 1)/hour in India vs Rs. 296.45 (US$ 3.5)/hour in China). Suppliers that serve India’s automotive and manufacturing sectors – with expertise in forging, stamping, and casting – often also make hand tools. As a result, many small and medium enterprises (MSMEs) thrive. Key clusters include Ludhiana, Rajkot, Jalandhar (Punjab), and Solingen (Gujarat).

- Power tools: India is still emerging. It holds ~2% of the global pneumatic power tools market (nailers, impact wrenches) but under 1% of electric power tools (corded and cordless drills, saws). A lack of a comprehensive electronics and battery manufacturing ecosystem has limited scale. For example, in 2018, Bosch produced 17 million power tools and battery packs in Malaysia versus only 2 million units’ capacity in India.

- Export ecosystem: India’s tool industry is MSME-dominated. A few leading players – Groz Engineering, JK Files, Shiv Forgings, Gardex, HR International account for ~25% of hand tool exports. Beyond these, thousands of small firms supply niche segments.

- Key products exported from India include spanners, wrenches, screwdrivers, knives, and other hand-held tools. Electric and battery-powered tools exports remain nascent.

Despite these strengths, India’s overall market presence remains modest. Expanding beyond current strongholds and moving up the value chain are necessary to tap into a multi-billion dollar opportunity.

Growth potential

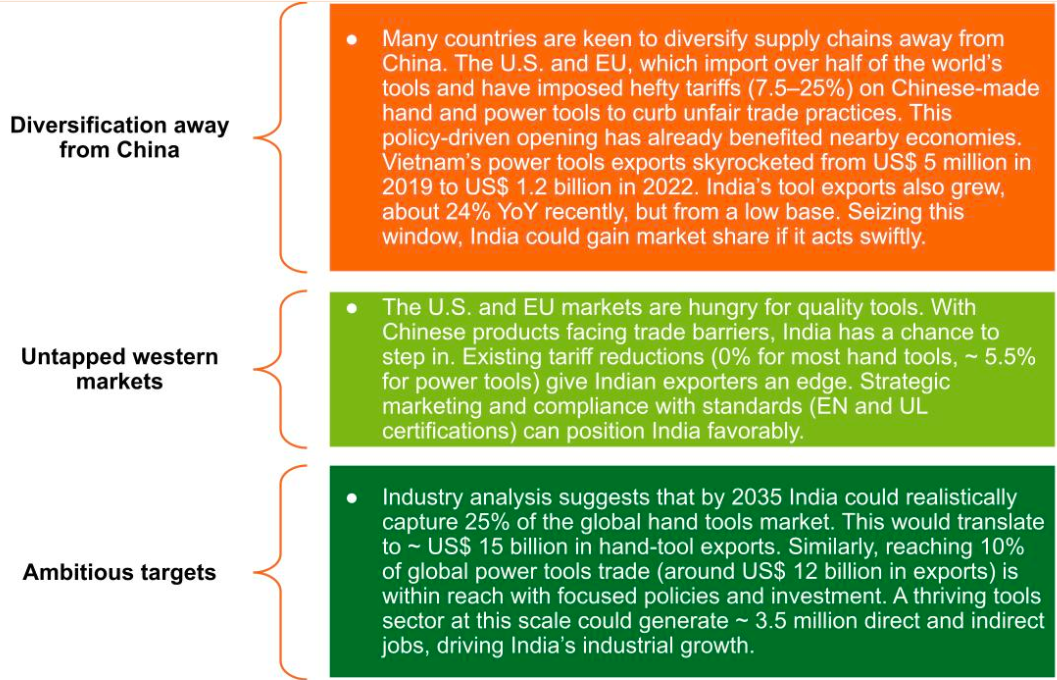

Global shifts are rapidly creating opportunities for India in the tools sector:

Government initiatives

Both the Centre and state governments have introduced schemes to boost manufacturing, but for tools, benefits have been modest:

Central schemes:

- Remission of Duties and Taxes on Exported Products (RoDTEP): Offers export rebates to offset embedded taxes. Hand tool exporters currently get a 1.1% rebate on Free on Board (FOB) value, (FOB value is a shipping term indicating the point at which responsibility and ownership of goods transfer from the seller to the buyer), and power tool exporters, 0.9%.

- Duty Drawback / Duty Free Import Authorisation (DFIA): Allows duty-free import of inputs with post-export duty refunds. Under the standard input norms, Indian toolmakers can recover 1.5–2.0% of input costs via drawback.

These benefits help, but they cumulatively cover only a small fraction of the 14–17% cost gap.

State schemes:

- Punjab offers incentives under its industrial policy (lower land costs, tax breaks), but many promised benefits are constrained by fiscal limits.

- Maharashtra, through its industrial and export policies, provides targeted aid: electricity duty subsidies Rs. 0.50–1 (US$ 0.0059 – 0.012) per unit in undeveloped areas for three years), interest subsidies (5% cap on loan interest in certain regions), and export incentives (1% on YoY export growth for the first five years). Combined with central schemes, a medium enterprise in Maharashtra sees a ~5.3% total benefit.

- Other States: Some provide land allotment at concessional rates and skill training support, but these are often limited to SMEs and a few industrial zones.

Even with all incentives, the effective support amounts to only 4–6% of revenue for a typical tool manufacturer far short of covering the structural cost disadvantage. Moreover, most schemes target small firms, leaving larger factories with less assistance.

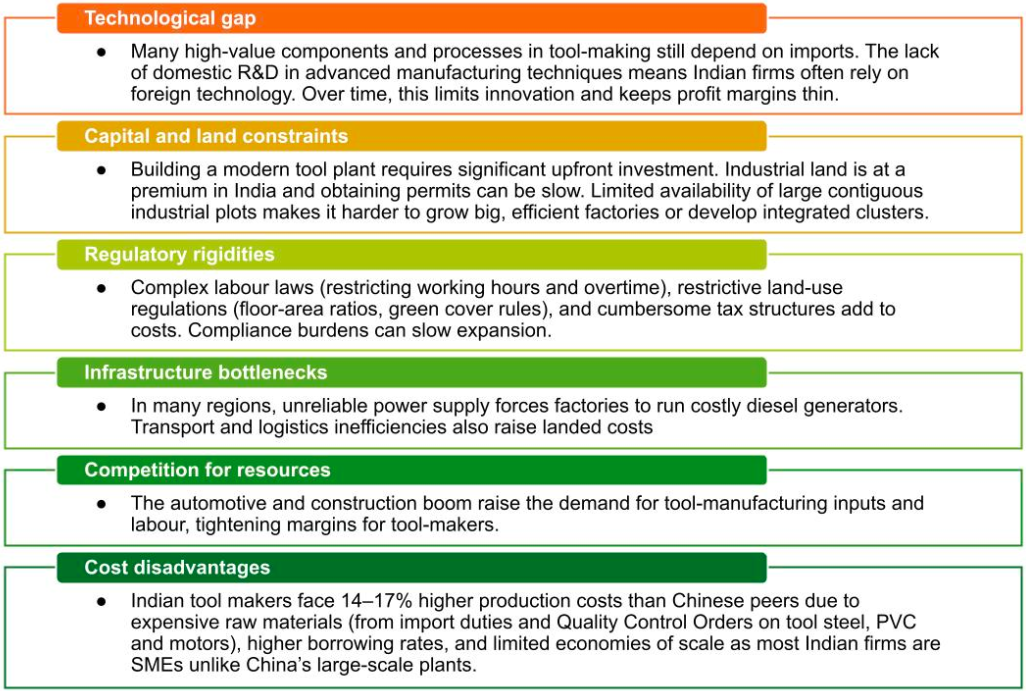

Challenges

Realising the above potential requires overcoming persistent challenges in India’s tools industry. Key hurdles include:

Conclusion

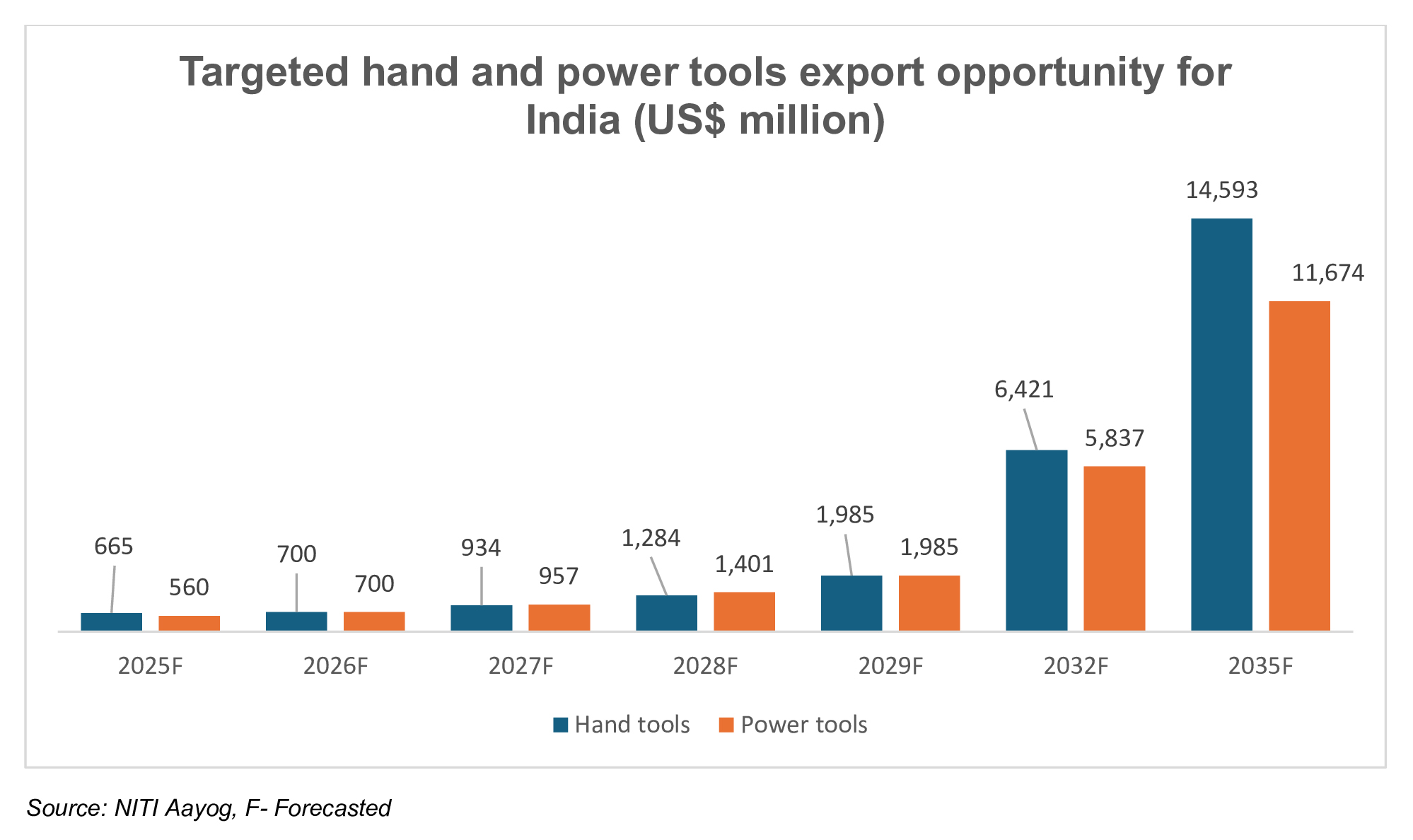

The India Hand & Power Tools sector stands at a pivotal juncture. With a well-developed MSME base, low labour costs, and a global market in flux, India has a real chance to transform from a minor exporter into a global leader. To achieve ~Rs. 2,11,375 crore (US$ 25+ billion) in exports by 2035 with Rs. 1,26,825 crore (US$ 15 billion) from hand tools and Rs. 1,01,460 crore (US$ 12 billion) from power tools, decisive action is needed.

The takeaway for policy makers is that they should seize the opportunity now and that the return will be more than worth it. By implementing these suggestions, India has a chance to gain the market share forfeited by the competitors and create a self-sufficient industry with a large contribution to GDP and exports. This, in turn, will cement India as a strong global manufacturing powerhouse and make it less vulnerable to future supply-chain disruptions. With coordinated policy support and industry effort, India’s tools sector can truly unlock its ~Rs. 2,11,375 crore (US$ 25+ billion) export potential and become a cornerstone of the nation’s manufacturing growth.