Foreign Direct Investment (FDI)

Introduction

Foreign Direct Investment (FDI) stands as a key catalyst for India's economic growth, constituting a substantial non-debt financial reservoir for the nation's developmental endeavours. International corporations strategically invest in India, capitalizing on the country's unique investment incentives, including tax incentives and relatively competitive labour costs. This not only facilitates the acquisition of technological expertise but also fosters job creation and various ancillary advantages. The influx of these investments into India is a direct result of the government's proactive policy framework, a dynamic business environment, improving global competitiveness, and a burgeoning economic influence.

The implementation of the Goods and Services Tax (GST) has further simplified the tax framework and increased transparency, while Special Economic Zones (SEZs) continue to offer infrastructure support and fiscal incentives that appeal to global investors. Recent policy momentum includes legislative approval to raise the FDI ceiling in the insurance sector from 74% to 100%, expected to broaden participation by international insurers and deepen capital flows into the financial sector. The cumulative amount of FDI equity inflows received during (April 2000-December 2025) was Rs. 51,85,639 crore (US$ 776.75 billion). This FDI has come from more than 170 countries that have invested across 33 states and UTs and 63 sectors in the country.

India has reached a significant milestone in its economic development, with gross foreign direct investment (FDI) inflows totalling an impressive US$ 1.14 trillion since April 2000. FDI equity inflows during April–December 2025 (FY26) increased to Rs. 4,16,709 crore (US$ 47,874 million), up from Rs. 3,40,962 crore (US$ 40,672 million) in the corresponding period of April–December 2024 (FY25). The rise represents a robust 22% year-on-year expansion in rupee terms, reflecting continued strength in foreign investment activity and sustained confidence in India’s growth trajectory.

Market Size

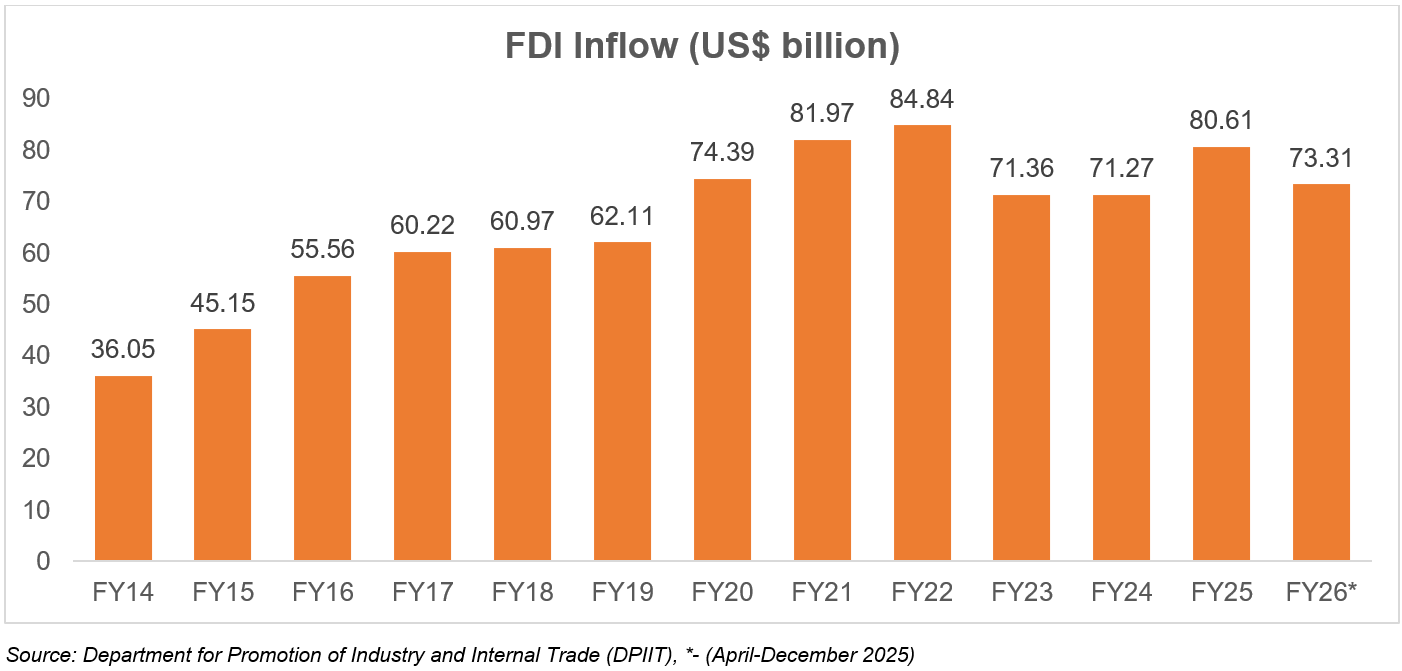

India's FDI inflows have increased ~20 times from FY01 to FY25. According to the Department for Promotion of Industry and Internal Trade (DPIIT), India's cumulative FDI inflow stood at US$ 1.14 trillion between April 2000-december 2025, mainly due to the government's efforts to improve the ease of doing business and easing of FDI norms. The total FDI inflow into India from April-December 2025 stood at Rs. 6,44,218 crore (US$ 73.31 billion) and FDI equity inflow for the same period stood at Rs. 4,16,709 crore (US$ 47.87 billion).

From April 2000-December 2025, India's service sector attracted the highest FDI equity inflow of 16% amounting to Rs. 8,39,105 crore (US$ 127.26 billion), followed by the computer software and hardware industry at 16%, amounting to Rs. 8,77,697 crore (US$ 121.40 billion), trading at 7% amounting

to Rs. 3,63,768 crore (US$ 50.93 billion), telecommunications at 5% amounting to Rs. 2,42,038 crore (US$ 40.18 billion), and automobile industry at 5% amounting to Rs. 2,64,456 crore (US$ 39.68 billion).

India also had major FDI inflows during April 2000-December 2025, coming from Singapore at Rs. 13,72,320 crore (US$ 192.53 billion) with a total share of 25%, followed by Mauritius at 24% with Rs. 11,34,884 crore (US$ 185.02 billion), the USA at 10% with Rs. 5,60,990 crore (US$ 78.45 billion), the Netherlands at 7% with Rs. 3,82,995 crore (US$ 55.60 billion), and Japan at 6% with Rs. 3,11,507 crore (US$ 47.59 billion).

The state that received the highest FDI equity inflow during April 2000-December 2025, was Maharashtra with Rs. 8,31,492 crore (US$ 104.06 billion) at 31%, followed by Karnataka at 21% with Rs. 5,42,157 crore (US$ 68.80 billion), Gujarat at 15% with Rs. 3,91,613 crore (US$ 49.90 billion), Delhi at 13% with Rs. 3,26,373 crore (US$ 41.33 billion), and Tamil Nadu at 6% with Rs. 1,48,875 crore (US$ 18.51 billion).

Investments/Developments

India has become an attractive destination for FDI in recent years, influenced by several factors that have boosted FDI. In the Global Innovation Index (GII) 2025, India secured the 38th position among 139 global economies. This marks a significant improvement from its 81st rank in 2015, demonstrating India's commitment to fostering a robust innovation ecosystem that is underpinned by strong policies, investment in research and development (R&D), and a collaborative environment for startups and industries. These factors have boosted FDI investments in India. Some of the recent developments are as follows:

- Foreign portfolio flows during April–December 2025 reflected phases of inflows and portfolio rebalancing, with strong inflows recorded in May, October and November, offsetting part of the volatility observed in other months amid global risk-off conditions.

- Foreign Portfolio Investment flows in 2025 reflected diversified allocation across asset classes amid evolving global conditions. Debt segments recorded net inflows of Rs. 8,849 crore (US$ 1,021 million), while mutual fund investments remained supportive with net inflows of Rs. 56,817 crore (US$ 6,503 million), alongside positive participation in hybrid and AIF categories. The continued engagement across non-equity segments highlights sustained foreign investor confidence in India’s capital markets.

- India and the European Union have concluded negotiations for a comprehensive Free Trade Agreement (FTA), marking a major milestone in one of India’s most strategic economic partnerships. The agreement covers a combined market of Rs. 2,091.6 lakh crore (US$ 24 trillion) and provides preferential access for over 99% of India’s exports by trade value, significantly expanding trade opportunities. The FTA is expected to unlock substantial untapped trade potential, deepen market integration, and strengthen long-term economic ties between India and the EU.

- India and the European Union concluded negotiations for a Free Trade Agreement, unlocking access to the EU pharmaceuticals and medical devices market valued at Rs. 49.19 lakh crore (US$ 572.3 billion) and providing preferential, duty-free access for key ‘Made in India’ products.

- The World Bank has ranked India among the top five countries globally in terms of private investment in infrastructure among low- and middle-income economies, with India accounting for over 90% of South Asia’s total private infrastructure investment.

- India and Oman have signed a Comprehensive Economic Partnership Agreement (CEPA) to deepen trade in goods and services, investment, and professional mobility, granting India 100% duty-free access across 98.08% of tariff lines covering 99.38% of its exports.

- India and New Zealand announced the conclusion of a landmark Free Trade Agreement on 23 December 2025, marking one of India’s fastest-concluded FTAs with a developed country and a major step towards Viksit Bharat 2047. The agreement provides zero-duty market access for 100% of India’s exports and offers New Zealand’s most ambitious services commitments to India, covering over 118 services sectors.

- The Italy–India Business Forum 2025 was held in Mumbai on 11 December 2025 during the visit of Italy’s Deputy Prime Minister Antonio Tajani, marking a key milestone in strengthening bilateral economic ties. The Forum focused on expanding trade, enhancing supply-chain resilience, and deepening cooperation across sectors such as automotive, clean energy, agri-food, sports technologies, and connectivity.

- The Union Minister of Commerce and Industry, Mr. Piyush Goyal, announced that India and Canada will start discussing the Terms of Reference (ToR) to set up a Free Trade Agreement (FTA). According to the Minister, both countries want to begin formal engagement again in trade matters and will formulate the groundwork for upcoming negotiations. Consequently, the ToR discussions will define the affected areas, objectives, and framework of the proposed trade agreement.

- On 14 October 2025, Bharti Airtel announced a strategic partnership with Google to establish India’s first Artificial Intelligence hub in Visakhapatnam, Andhra Pradesh, aimed at accelerating AI adoption and strengthening the country’s digital infrastructure. The initiative entails a proposed investment of around Rs. 1,25,000 crore (US$ 15 billion) over 2026–2030 to develop large-scale data centres, subsea cable connectivity, and clean energy-supported digital infrastructure.

- India and Zambia signed a memorandum of understanding (MoU) on July 18 to promote cooperatives and facilitate trade alliances between the two nations. Union Home Minister and Minister of Cooperation, Mr. Amit Shah, informed the Lok Sabha that the Cooperation Ministry is working to strengthen India's cooperative export ecosystem through Indian missions abroad. The ministry is using Indian missions to provide market information to the National Cooperative Exports Ltd (NCEL) and connect it with importers in specific countries.

- India is emerging as a reliable alternative hub in the global semiconductor supply chain, supported by strong domestic demand and policy push. India’s semiconductor market, valued at about US$ 38 billion in 2023, is projected to nearly triple to ~US$ 109 billion by 2030, driven by growth in smartphones, automotive electronics, industrial automation, and data centres. To cut import dependence and attract fabs and advanced packaging units, the government launched a US$ 10 billion incentive scheme in 2021 under the India Semiconductor Mission. As of October 2025, 10 projects across six states have been approved, with total investments exceeding Rs. 1.6 trillion (US$ 18–19 billion), cementing India’s position as a key player in the global semiconductor ecosystem.

- The Union Cabinet has approved four new semiconductor projects under the India Semiconductor Mission, taking the total approved projects to 10 with a cumulative investment of Rs. 1.60 lakh crore (US$ 18–19 billion). These include India’s first Silicon Carbide compound fab and an advanced packaging unit, strengthening domestic chip manufacturing and jobs.

- The OECD has raised India’s FY26 GDP growth forecast to 6.7%, citing monetary and fiscal easing along with recent GST cuts, and expects inflation to ease to 2.9%. S&P Global has retained its FY26 growth outlook at 6.5%, supported by strong domestic demand and higher government investment, while trimming its inflation estimate to 3.2% and expecting a small RBI rate cut.

- India and the UK have signed a Comprehensive Economic and Trade Agreement (CETA), providing duty-free access for 99% of India’s exports to the UK and expanding services market access in IT, finance, education, and digital trade. With bilateral trade at Rs. 4,83,784 crore (US$ 56 billion) and plans to double by 2030, the pact is expected to boost FDI flows, strengthen supply-chain linkages, and enhance India’s role in global trade.

- Significant opportunities exist to deepen collaboration between Indian and Japanese firms in the textiles sector, with Tokyo-based companies expressing keen interest to invest in India, according to the Apparel Export Promotion Council (AEPC). Chairman of Apparel Export Promotion Council, Mr. Sudhir Sekhri, highlighted that numerous meetings have been held between Indian and Japanese apparel companies to explore potential business partnerships. Several Indian exporters are participating in the India Tex Trend Fair (ITTF) in Tokyo, a flagship textiles event inaugurated by Union Minister of Textiles Mr. Giriraj Singh. The fair is organised jointly by the Embassy of India, the Ministry of Textiles, AEPC, and the Japan India Industry Promotion Association (JIIPA). He urged Japanese firms to increase sourcing and investments in India, citing successful discussions with major brands such as Uniqlo, Adastria, Toray, Itokin, Broque Japan, Daiso, YKK, and Pegasus.

- India has cleared Starlink to begin commercial satellite broadband services after final regulatory approval, capping subscriptions at two million users and targeting remote areas. As the third licensed satellite internet provider alongside OneWeb and Jio, Starlink’s entry highlights growing FDI participation in India’s space and digital connectivity ecosystem, supported by a liberalising regulatory environment.

- India’s green warehousing capacity is set to quadruple to 270 million sq. ft by 2030, with institutional-grade sustainable warehouses emerging as a major investment theme, according to JLL India. With over 45% of global investor portfolios already green-certified, rising ESG standards and strong logistics demand are strengthening FDI inflows into India’s modern, sustainable warehousing and supply-chain infrastructure.

- The Reserve Bank of India’s Financial Inclusion Index rose from 64.2 to 67 in FY25, reflecting stronger access, usage, and quality of formal financial services nationwide. Rising financial inclusion enhances household participation in the formal economy and strengthens India’s investment environment, supporting foreign investor confidence and long-term FDI inflows into banking, fintech, and financial services.

- India’s garment exports to Japan stood at Rs. 2,015 crore (US$ 234.5 million) in 2024, a modest share of Japan’s Rs. 1,97,639 crore (US$ 23 billion) apparel imports. The AEPC noted that India has a golden opportunity to significantly grow its presence in the Japanese market, supported by duty-free trade agreements, strong sustainability credentials, and a flexible manufacturing base underpinned by initiatives such as the PM MITRA Parks. However, challenges remain in improving quality standards, especially in man-made fibres (MMF), simplifying trade procedures, and adhering strictly to Japanese compliance norms to capture a greater share of the Rs. 3,00,755 crore (US$ 35 billion) Japanese apparel market.

- India’s data centre sector is expected to attract Rs. 1,60,000–2,00,000 crore (US$ 18.67–23.33 billion) in investment over the next 5–7 years, supported by strong demand growth and accelerating capacity expansion, according to India Ratings and Research. With hyperscalers and global cloud firms driving large-scale deployments, India continues to emerge as a major destination for FDI in digital infrastructure and AI-ready facilities.

- Thermal power investments in India are projected to rise to Rs. 2,30,000 crore (US$ 26.71 billion) by FY28, nearly doubling from recent years, with private sector participation expected to jump to about one-third of total funding, according to Crisil. With 80 GW of new thermal capacity planned by 2031–32, growing investor participation, especially from private players, signals renewed FDI interest in India’s power infrastructure alongside its clean-energy transition.

- As per Savills India Research, Global Capability Centre (GCC) leasing in India is projected to range between 120–246 million sq. ft. during 2025–2030, depending on global business conditions, with a realistic estimate of around 180 million sq. ft. over the period. This translates into an average annual leasing of nearly 30 million sq. ft. over the next six years and implies a CAGR of about 8.2% compared to the 112 million sq. ft. leased during 2020–2024.

- India ranked third globally in fintech startup funding in H1 2025, attracting Rs. 7,593 crore (US$ 889 million), led by strong early-stage and M&A activity, according to Tracxn. Sustained investor interest, supportive regulatory signals, and Bengaluru’s leadership in fundraising continue to strengthen FDI flows into India’s fintech ecosystem.

- HCLTech has entered a multi-year strategic collaboration with OpenAI, positioning itself among OpenAI’s first global services partners to scale enterprise generative AI adoption. The partnership is expected to boost high-value technology investment inflows into India’s AI ecosystem, strengthen the country’s position as a global digital services hub, and support multinational enterprises in deploying AI-driven transformation at scale.

- The Union Cabinet has approved a Rs. 1,00,000 crore (US$ 11.68 billion) Research, Development, and Innovation Scheme to boost private-sector R&D in advanced technologies such as AI, green tech, and deep-tech. By offering long-term concessional finance and equity support, the scheme is expected to strengthen India’s innovation ecosystem and attract high-value foreign investment into strategic technology sectors.

- India recorded its highest-ever renewable energy expansion in 2025, adding 44.51 GW of capacity till November, nearly double the 24.72 GW added during the same period last year. India’s accelerating clean-energy deployment and policy momentum are further strengthening its appeal for long-term investment in green infrastructure and technology.

- Union Minister of Commerce and Industry, Mr. Piyush Goyal, stated that, in the past few months, investors worldwide have announced plans to invest over Rs. 50,000 crore (US$ 5.7 billion) in India's finance and banking sector, underscoring India’s emergence as a preferred destination amid global economic uncertainty.

Government Initiatives

In recent years, India has become an attractive destination for FDI because of favourable government policies. India has developed various schemes and policies that have helped boost India's FDI. These schemes have prompted India's FDI investment, especially in upcoming sectors such as defence manufacturing, real estate, and research and development. Some of the major government initiatives are:

- At the World Economic Forum (WEF) Davos 2026, Andhra Pradesh Chief Minister Mr. N. Chandrababu Naidu has received a significant investment commitment from the United Arab Emirates (UAE) to set up a food processing cluster in the state of Andhra Pradesh, marking the increasing attractiveness of India as a global investment destination.

- Maharashtra signed 19 MoUs worth Rs. 14.50 lakh crore (US$ ~174 billion) at the World Economic Forum in Davos, reinforcing the state’s position as a key investment gateway. The agreements span green energy, food processing, steel, IT-ITeS, data centres, EVs, and digital infrastructure, and are expected to generate 15 lakh jobs, with further MoUs anticipated in AI, quantum computing, fintech, logistics, and renewable energy sectors.

- India and the Philippines have joined forces to enhance their space and electronics industries, with the Satcom Industry Association-India (SIA-India) and the Electronic Industry Association of the Philippines Inc (EIAPI) signing an MoU to promote cooperation. This partnership aims to deepen industry-to-industry links and enable collaborative manufacturing, joint research, and innovation in satellite communication hardware, embedded systems, Internet of Things (IoT) devices, and space electronics.

- Uttar Pradesh is rapidly emerging as a major investment destination, driven by tech-enabled governance reforms like Nivesh Mitra 3.0, which streamlines approvals through PAN-based authentication, single-window clearance, and real-time digital tracking. The platform enhances transparency, integration, and accessibility, especially for MSMEs, helping investors navigate the setup and growth process smoothly in the state.

- Commerce & Industry Minister Mr. Piyush Goyal announced that the government is finalising a dedicated scheme to boost domestic toy manufacturing, strengthening design, quality, and branding capabilities. With exports rising to 153 countries and strong policy support, including quality standards and MSME cluster development, India’s evolving toy sector is increasingly attractive for FDI-led manufacturing partnerships and global value-chain integration.

- Finance Minister Ms. Nirmala Sitharaman announced that the proposal to raise FDI limits in insurance to 100% is expected to lift sectoral growth to 7.1% annually over the next five years, attracting stable foreign capital and improving insurance penetration. Simplified ownership rules are set to enhance competition, technology transfer, and investor participation, reinforcing India’s reform-driven FDI policy environment in financial services.

- India is advancing a Rs. 60,000 crore (US$ 6.94 billion) scheme to modernise 1,000 Industrial Training Institutes under a hub-and-spoke model, partnering with leading Indian and global companies to train two million youth over five years. With co-financing support from multilateral institutions, the initiative will expand India’s skilled workforce and further strengthen the country’s attractiveness for FDI in manufacturing and high-value industries.

- The Union Cabinet has approved the Rs. 24,000 crore (US$ 2.79 billion) PM Dhan-Dhaanya Krishi Yojana to modernise agriculture across 100 districts from FY26, alongside expanding renewable energy investments through NTPC (Rs. 20,000 crore / US$ 2.33 billion) and NLC India (Rs. 7,000 crore / US$ 814.6 million). These initiatives strengthen India’s agricultural productivity and green-energy transition, reinforcing the country’s attractiveness for FDI in agri-value chains and clean-energy infrastructure.

- Large-scale electronics and pharmaceutical manufacturing accounted for ~70% of total PLI disbursements in FY25, with electronics firms receiving Rs. 5,732 crore (US$ 666.3 million) and pharmaceuticals Rs. 2,328 crore (US$ 270.6 million) out of Rs. 10,114 crore (US$ 1.18 billion) released across 14 sectors. Introduced with a total outlay of Rs. 1,97,000 crore (US$ 22.90 billion), the PLI scheme is strengthening India’s manufacturing base and export competitiveness, key drivers for FDI inflows into high-value sectors. Electronics exports rose 32.46% in FY25 to Rs. 3,31,904 crore (US$ 38.58 billion), while pharmaceutical exports climbed 10% to Rs. 2,62,392 crore (US$ 30.5 billion), underscoring India’s growing role in global value chains.

- India is strengthening its flagship AB PM-JAY health insurance scheme, now covering 1,961 procedures across 27 specialties and backed by over 1.77 lakh Ayushman Arogya Mandirs delivering primary care nationwide. By expanding access to affordable, quality healthcare, these reforms support social infrastructure and create a stronger foundation for FDI in healthcare services, life sciences, and medical technology.

- As part of the Union Budget 2025-26, the government has raised the sectoral cap for the insurance sector from 74% to 100%. Additionally, an Investment Friendliness Index for states will be introduced this year. The government is also set to launch Jan Vishwas 2.0 to enhance the business environment further.

- Government permits 100% Foreign Direct Investment via automatic route for Aircraft Maintenance, Repair and Overhaul (MRO).

- The government is taking steps such as facilitating foreign direct investments, nudge prioritisation, and promoting opportunities for using Indian rupee as a currency for overseas investments to simplify FDI regulations and to speed up the approval process.

- The Union Cabinet approved the signing and ratification of a Bilateral Investment Treaty between India and the United Arab Emirates aiming to boost investor confidence, attract foreign investments, and create opportunities for overseas direct investment, potentially leading to job creation. Additionally, it is anticipated to stimulate investments in India, aligning with the vision of ‘Atmanirbhar Bharat’ by promoting domestic manufacturing, reducing import reliance, and boosting exports.

- The Union Cabinet approved an amendment to the Foreign Direct Investment (FDI) policy concerning the Space Sector, aligning with the vision of ‘Atmanirbhar Bharat’ outlined by Prime Minister Mr. Narendra Modi. This amendment liberalised the Space sector, allowing 100% foreign direct investment in specified sub-sectors/activities. The reform is expected to improve the Ease of Doing Business in India, attract greater FDI inflows, and stimulate investment, income, and employment growth.

- In line with the 'Atmanirbhar Bharat' vision, the Union Cabinet approved the PLI Scheme for White Goods (Air Conditioners and LED lights) with a budget of Rs. 6,238 crore (US$ 752 million) from FY 2021-22 to FY 2028-29. The scheme has approved 64 applicants, with a total committed investment of Rs. 6,766 crore (US$ 816 million).

- FDI equity inflows in India's manufacturing sector have seen significant growth, particularly over the last decade. The government reports indicate a 69% increase in FDI equity inflows in the manufacturing sector from Rs. 8,37,191 crore (US$ 97.7 billion) during 2004-14 to Rs. 14,14,742 crore (US$ 165.1 billion) during 2014-24. This growth is attributed to various factors, including the Make in India initiative, Production-Linked Incentive (PLI) scheme, and India's overall economic growth.

- The Government of India increased FDI in the defence sector by liberalizing it to 74% through the automatic route and 100% through the government route.

- The Foreign Investment Facilitation Portal (FIFP) is a new online single-point interface of the government for investors to facilitate Foreign Direct Investment proposals to evaluate and further authorise them under the Government approval route.

- The sectoral cap for the pharmaceutical industry has been lowered, 74% of FDI is permitted in the Brownfield pharma sector via the automatic method, and 100% is permitted via the approved route.

- In the civil aviation sector, 100% FDI is allowed under automatic routes in brownfield airport projects.

- For single-brand retail trading, local sourcing norms have been relaxed for up to 3 years and 100% FDI is allowed under automatic route.

- The government has amended the Foreign Exchange Management Act (FEMA) rules, allowing up to 20% FDI in insurance company LIC through the automatic route.

- Many reforms like National Technical Textiles, Silk Samagra-2 scheme, Seven Pradhan Mantri Mega Integrated Textile Region and Apparel (PM MITRA) Parks, Production Linked Incentive (PLI) Scheme for Textiles to promote the production of Man-Made Fibre (MMF) Apparel, MMF Fabrics and Products of Technical Textiles, and more initiatives are taken by the government to enhance export and to promote FDI in the textile sector.

Road ahead

Foreign Direct Investment continues to anchor India’s long-term growth trajectory, supported by consistent policy reforms, expanding market access, and deepening global integration. Strong equity inflows in FY26, alongside the steady expansion of high-technology, manufacturing, and green energy sectors, reflect sustained investor engagement despite global volatility. Recent trade agreements with key partners, including the European Union and other strategic economies, are widening export access and strengthening India’s integration into global value chains. Continued liberalisation across sectors, infrastructure scale-up, renewable energy expansion, and digital transformation initiatives are further enhancing India’s competitiveness, positioning the country as a preferred destination for strategic, long-term capital in the years ahead.