SEARCH

RECENT POSTS

Categories

- Agriculture (28)

- Automobiles (18)

- Banking and Financial services (31)

- Consumer Markets (46)

- Defence (6)

- Ecommerce (20)

- Economy (66)

- Education (12)

- Engineering (6)

- Exports (21)

- Healthcare (24)

- India Inc. (8)

- Infrastructure (29)

- Manufacturing (26)

- Media and Entertainment (13)

- Micro, Small & Medium Enterprises (MSMEs) (15)

- Miscellaneous (30)

- Perspectives from India (33)

- Pharmaceuticals (4)

- Railways (4)

- Real Estate (16)

- Renewable Energy (17)

- Research and Development (8)

- Retail (1)

- Services (6)

- Startups (15)

- Technology (53)

- Textiles (6)

- Tourism (12)

- Trade (5)

Fuelling Fitness: The Rapid Growth of India’s Protein Market

- Oct 13, 2025, 17:50

- Consumer Markets

- IBEF

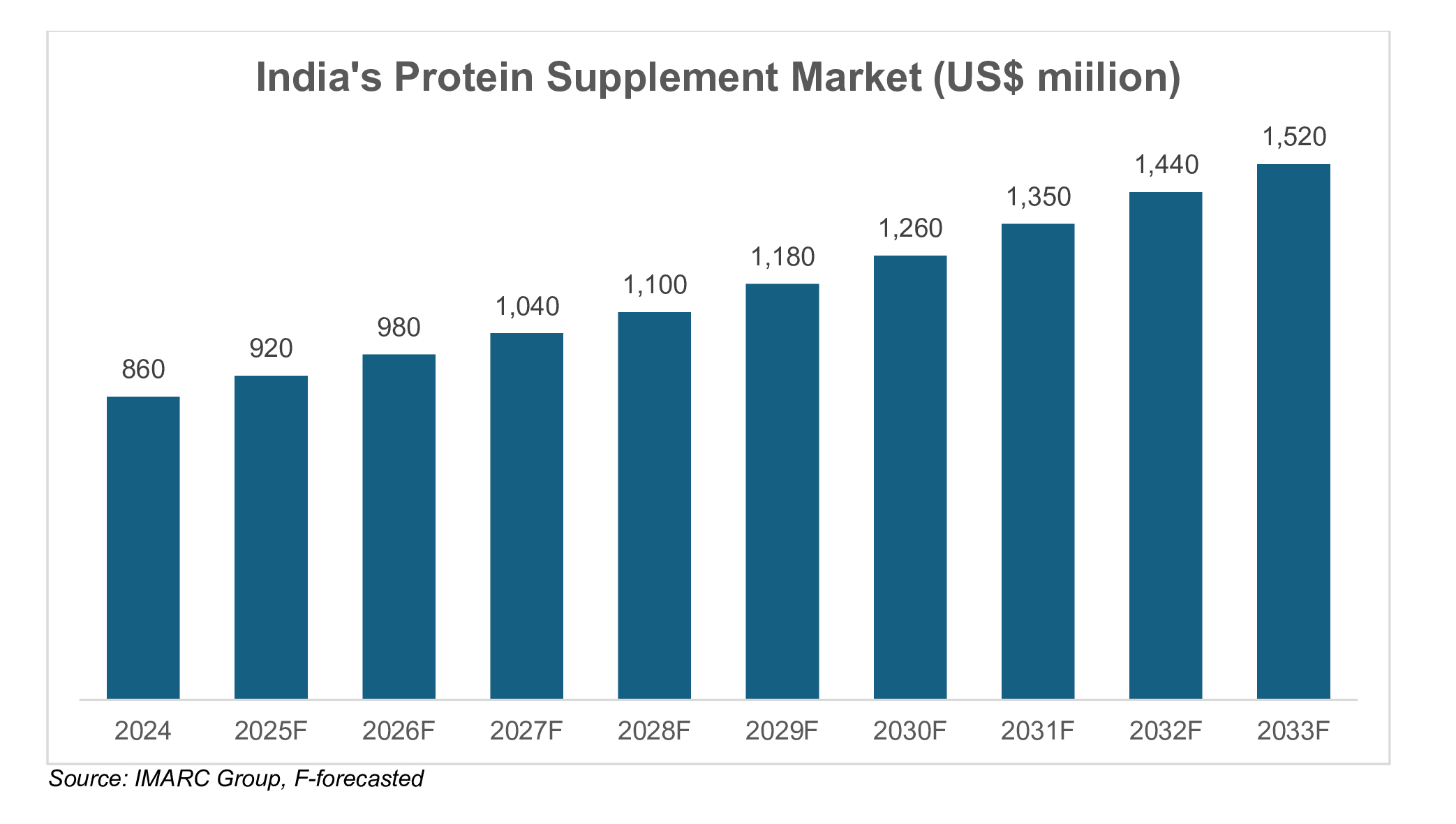

India is witnessing a nutrition-driven move, with protein supplements becoming a key component in preventive health and wellness. From professionals to seniors, a developing section of buyers is presently turning to daily protein supplements for immunity, muscle recuperation and sustained energy. Brands such as MuscleBlaze, Amul and Oziva are responding with reasonable, affordable groups and clean-label arrangements to cater to this expanding demand. According to IMARC group, the protein supplement market in India was valued at Rs. 7,461 crore (US$ 860 million) in 2024 and is anticipated to reach Rs. 13,186 crore (US$ 1.52 billion) by 2033 at a compound annual growth rate (CAGR) of 6.6%. This growth is especially visible in metros and high-potential cities such as Lucknow, Surat and Indore, where packet-based protein powder supplements are picking up momentum. As awareness of diverse types of protein supplements is spreading through social media, wellness influencers and health apps, the demand for these protein supplements is accelerating, marking a major shift in India’s approach to regular nourishment.

Key segments in India’s protein supplement market

India’s protein supplement market in India includes a variety of product types, each catering to specific health, fitness and nutritional requirements. The following is a summary of the principal groups in this market, their performance, and how they are being used by Indian consumers:

- Whey Protein:

- According to MarkNtel, the whey protein market size stood at Rs. 795 crore (US$ 92.03 million) in 2023 and is anticipated to reach Rs. 1,078 crore (US$ 125.2 million) by 2030 at a CAGR of 5.08%.

- Types of whey include whey protein concentrate (WPC), whey protein isolate (WPI) and hydrolysed whey.

- Generally used by wellness seekers and athletes for post-workout muscle recovery and muscle mass maintenance.

- Plant-Based Protein:

- According to Mordor Intelligence, the plant-based protein marketplace stood at Rs. 8,594 crore (US$ 998 million) by 2025 and is expected to increase to Rs. 11,625 crore (US$ 1.35 billion) by 2030 at a CAGR of 6.3%.

- Key sources incorporate soy, pea, rice, mung bean and hemp proteins.

- Vegetarians and those who are unable to digest lactose use this as a daily protein supplement that supports immunity, energy levels and economical nourishment.

- Alternative Protein:

- According to Grandview research group, the alternative protein market was roughly valued at Rs. 6,853 crore (US$ 795.9 million) in 2023 and is anticipated to reach Rs. 12,658 crore (US$ 1.47 billion) by 2030 at a CAGR of 9.1%.

- It is gaining momentum due to high bioavailability and sustainability.

- Arising as a nutrient-rich protein source for forward-thinking consumers to concentrate on climate-conscious and sustainable diets, especially in nutrition bars.

- Microparticulate Whey Protein:

- According to Grandview research, a niche item inside the broader whey group, microparticulate whey protein was roughly valued at Rs. 27 crore (US$ 3.1 million) in 2024 and is anticipated to reach Rs. 43 crore (US$ 5.3 million) by 2030 at a CAGR of 9.8%.

- It is used in high-protein yoghurts, smoothies and clinical nourishment where surface, taste and digestibility are important especially for the elderly or patients with compromised digestion.

Regional demand for protein supplements in India

The India’s protein market is seeing shifted development patterns over various regions, impacted by components such as urbanisation, fitness awareness, earning levels and access to organised retail chains. While metros proceed to lead in utilisation, non-metro cities are quickly catching up. Below is the region-wise breakdown of protein powder supplement utilisation in India:

- Northern Region:

- Holds the largest share of the India protein supplement market.

- Driving 35% of the total market in India.

- Higher concentration of urban centers, fitness clubs in cities such as Delhi, Chandigarh and Lucknow.

- Western Region:

- Contributes around 28% of the protein supplement market in states such as Mumbai, Surat and Jaipur.

- In this region, an increasing participation in marathons, cycling events and gym memberships has created a favourable environment for protein product consumption.

- Southern Region:

- Accounts for roughly 22% of protein market in states such as Bengaluru, Chennai and Hyderabad.

- This region has shown a strong preference for creative and flavoured protein products, including bars and ready-to-drink options that suit fast-paced lifestyles.

- Eastern Region:

- Holds the smallest market share of about 15% in cities such as Bhubaneswar and Patna

- As e-commerce platforms and regional supplier chains are improving their outreach in Eastern India, the availability of daily protein is increasing.

Leading protein brands and market trends

India’s protein supplement market in India is led by a blend of homegrown and transnational brands, each distinguishing itself with unique inventions and strong social media engagement. Some key players in this market are:

- Muscle Blaze and Optimum Nutrition, which dominate accounting for 20% of the protein powder market in India.

- Plant-based brands such as Oziva and TrueBasics target vegan consumers and are very popular among younger generations.

- Brands such as MyProtein that offer nutrition mix blends and have emerged as top choices in the alternative protein category.

- Parag Milk Foods (Avvatar), which unlocked its potential in the whey protein market in India by offering dairy-derived whey powder across retail.

- Himalaya Wellness and Zydus Wellness, which target a broader audience with daily protein supplements in liquid and bar formats.

Drivers and disruptors in India’s protein market

As India’s protein supplement market continues to expand rapidly, several structural and consumer-side dynamics are both gruelling and presenting new avenues for growth. A core concern in India remains the average protein input, which is currently measured roughly at 47 grams per person per day. This is below the ICMR recommended intake of 60 grams per day. However, the government has introduced certain schemes such as Poshan Abhiyaan and Eat Right India campaign by Food Safety and Standards Authority of India (FSSAI) for raising mindfulness about balanced diets and encouraging utilisation of daily protein supplements across age groups, including children, pregnant women, seniors and fitness-concentrated professionals.

Price perceptivity remains another challenge as imported protein powder supplements are costly which opens a window for affordable sachets, Indianised variants such as protein‑fortified lassi or atta, particularly in tier-2 and tier-3 cities. Meanwhile, support mechanisms from Start-up India and Production linked incentive (PLI) schemes for the food processing sector are enabling domestic production of whey protein, plant based, and alternative protein variants at lower costs.

Eventually, digital channels and social media through fitness influencers, health apps and educational programmes are playing a crucial part in popularising different types of protein supplements, debunking myths and encouraging correct utilisation in the broader protein powder market in India.

Building a healthier India with protein supplements

India’s evolving protein geography reflects a growing shift toward preventive health and nutrition- concentrated cultures. With rising demand across metros and non-metros, innovative product formats and demand of daily protein needs, the protein supplement market in India is set for sustained expansion. Government programmes, digital outreach and original manufacturing are further accelerating access and affordability. As consumers are more informed about types of protein supplements, the country’s protein powder market will continue to diversify and help in bridging the gap between fitness, wellness and everyday nutrition.

FAQs

What is the current size of the protein supplement market in India?

The protein supplement market in India was valued at approximately Rs. 7,461 crore (US$ 860 million) in 2024 and is projected to grow to Rs. 13,186 crore (US$ 1.52 billion) by 2033, with increasing demand across age groups.

Which brands dominate the protein powder market in India?

Top brands in the protein powder market in India include MuscleBlaze, Optimum Nutrition, Oziva, TrueBasics and Parag Milk Foods (Avvatar). These brands offer a wide range of protein powder supplements catering to diverse needs.

What are the most common types of protein supplements consumed in India?

The most popular types of protein supplements in India include whey protein, plant-based protein and emerging alternative protein products such as blends and bars tailored for vegans and fitness enthusiasts.

How is social media helping the growth of protein supplements in India?

Social media platforms play a vital role in promoting protein supplements India, especially through influencer marketing, fitness campaigns and brand partnerships that spread awareness about daily protein supplements.

What are the latest trends in the protein supplement market in India?

Key protein market trends include growing demand for plant-based proteins, flavoured and ready-to-drink options and clean-label products. Regional adoption is also rising, expanding the India protein supplement market to tier-2 and tier-3 cities.