SEARCH

RECENT POSTS

Categories

- Agriculture (28)

- Automobiles (18)

- Banking and Financial services (31)

- Consumer Markets (46)

- Defence (6)

- Ecommerce (19)

- Economy (66)

- Education (12)

- Engineering (6)

- Exports (21)

- Healthcare (24)

- India Inc. (8)

- Infrastructure (29)

- Manufacturing (26)

- Media and Entertainment (13)

- Micro, Small & Medium Enterprises (MSMEs) (15)

- Miscellaneous (30)

- Perspectives from India (33)

- Pharmaceuticals (4)

- Railways (4)

- Real Estate (16)

- Renewable Energy (17)

- Research and Development (8)

- Retail (1)

- Services (6)

- Startups (15)

- Technology (53)

- Textiles (6)

- Tourism (11)

- Trade (5)

Energy Storage in India: Unlocking the Potential for a Sustainable Future

- Sep 15, 2025, 11:55

- Renewable Energy

- IBEF

India has emerged as a leader in clean energy within the G20. In fact, India became the first G20 country to meet its Paris Agreement commitments, and it has set an ambitious target of 500 gigawatts (GW) of renewable capacity by 2030. To reach this goal, India’s renewable power fleet has grown dramatically. Installed renewables (including large hydro) topped 203 GW by late 2024, up from roughly 75 GW a decade earlier. (Excluding large hydro, capacity jumped from about 39 GW in 2015 to 137 GW by early 2024.) This rapid expansion – often cited as roughly a 135% increase over FY15–FY24 – reflects strong policy support and investment. Such growth puts India on track to meet its 500 GW by 2030 goal, about 200 GW of which has already been built and underpins its clean-energy commitments on the world stage.

The role of energy storage in the renewable ecosystem

Energy storage is critical to make this renewable build-out reliable and sustainable. By buffering supply and demand, storage smooths the variability of solar and wind, improving grid stability and power quality. Storage systems also enable “time-shifting” of energy – charging when the sun is shining or wind is blowing and discharging during peak demand – which allows much higher penetration of renewables and deferral of costly grid upgrades. These services not only stabilize the grid, but they also boost energy access (by firming up intermittent power) and reduce emissions (by displacing fossil peakers).

The impact is already visible, today nearly half of India’s generation capacity is non-fossil. Renewables alone accounted for about 46% of total installed capacity by late 2024. Energy storage will be key to maintaining and growing this share of clean energy as India expands its solar and wind fleets.

Current energy storage landscape in India

India’s energy storage sector is still emerging, but growth and planning are rapid. Today, pumped hydro storage provides most bulk storage (existing projects total only a few gigawatts and hundreds of megawatt-hours), while grid-scale batteries are just beginning to roll out. Looking ahead, analyses see a big surge in storage needs. For example, the Central Electricity Authority projects 32 GW/160 GWh of battery storage will be needed by 2030 to support the 500 GW renewables target which consistent with industry estimates of ~160 Gigawatt hours (GWh) by 2030.

To meet this demand, the government is focusing on key areas:

Electric vehicles and battery manufacturing are high priorities: India has pushed EV adoption (with targets like 30% electric vehicle sales by 2030) and launched Production-Linked Incentive schemes to scale up local battery production. This will not only decarbonize transport but also build out battery supply for the grid.

At the same time, policy and infrastructure efforts are integrating storage with solar parks and hybrid projects. For instance, new solar parks increasingly include co-located battery storage, and large hybrid wind-solar parks (with storage) are being planned to balance output.

Experts note that innovations like vehicle-to-grid integration and hybrid renewable-plus-storage projects will further enhance grid reliability and security. In short, the ESS industry in India is gearing up – backed by government targets and new policies – to play a central role in the country’s clean-energy transition.

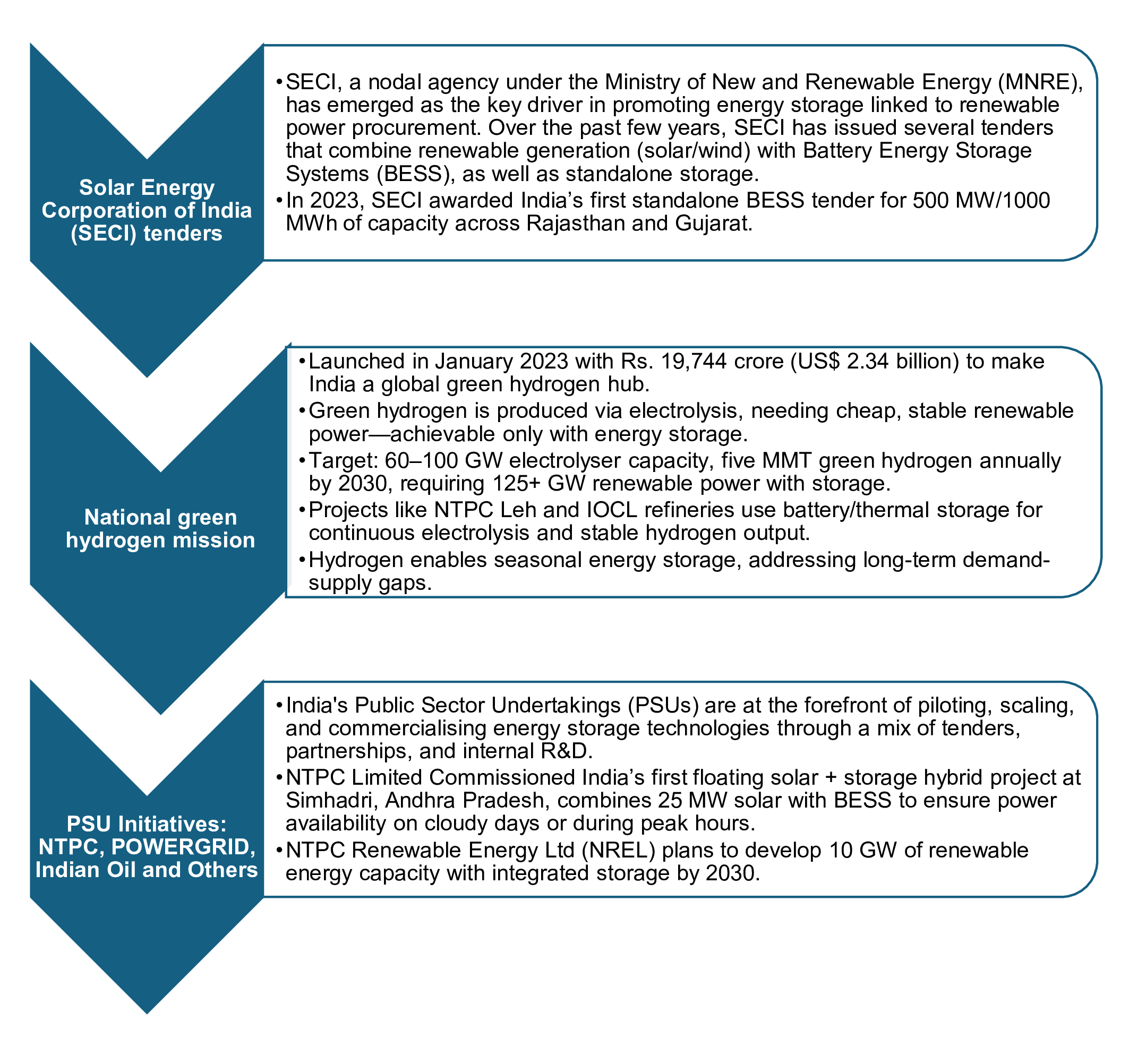

Key projects and developments

Combined, these PSUs have earmarked over Rs. 25,000 crore (US$ 3 billion) for clean energy initiatives involving storage over the next 5–7 years. The public sector's entry gives confidence to private players, ensuring that storage is not just an add-on, but a core asset in India's power ecosystem.

Types of energy storage technologies

Battery Energy Storage Systems (BESS)

Lithium-ion BESS is the most widely deployed technology due to high energy density, modularity, and cost decline. For example, Tata Power commissioned a 10 MWh BESS in Delhi, while JSW Energy is building a 500 MWh project under SECI’s standalone BESS tender. BESS is crucial for peak load shaving and renewable firming.

Pumped Hydro Storage (PHS)

India’s 4.8 GW of installed PHS includes projects like Tehri (Uttarakhand) and Purulia (West Bengal). These systems pump water to a higher elevation during surplus and release it to generate electricity during peak demand. NHPC and SJVN are exploring over 15 GW of new PHS capacity, particularly in hilly states.

Thermal Energy Storage

Used in industrial and CSP applications, thermal storage involves heat retention in media like molten salt. The NTPC Dadri plant evaluated a thermal energy storage pilot with phase change materials. L&T is also involved in developing CSP-based hybrid thermal storage solutions, aimed at supporting industrial load balancing and process heat needs.

Flow Batteries and Hydrogen Storage

Flow batteries, like vanadium redox, offer scalable long-duration storage with better safety. IIT Madras and IOCL are piloting flow battery prototypes. On the hydrogen front, NTPC is developing a green hydrogen project in Leh, integrating BESS and electrolysers to store energy as hydrogen, enabling seasonal storage and grid decarbonisation.

Policy and regulatory support

Recognising the strategic importance of energy storage, the Indian government has rolled out several initiatives:

- Production Linked Incentive (PLI) Scheme for Advanced Chemistry Cell (ACC) Batteries: Allocated Rs. 18,100 crore (US$ 2.14 billion) to support domestic manufacturing.

- Draft Electricity (Amendment) Bill: Proposed inclusion of energy storage as a distinct asset class.

- Energy Storage Roadmap by MNRE and NITI Aayog: Outlines capacity needs, technology preferences, and investment frameworks.

Additionally, states like Maharashtra, Gujarat, and Tamil Nadu are formulating storage policies in-line with their renewable energy goals.

Energy storage is the missing puzzle from India's clean energy journey. It promises to carry the load of ambition and action by making renewable energy dispatchable, reliable, and sustainable. Consequently, with technology costs being reduced, policy support growing, and innovations being accelerated, India is very well positioned to becoming an international leader in energy storage solutions.

Unlocking this potential will ensure energy security and climate resilience along with job creation, import dependency reduction, and enabling a sustainable future.