SEARCH

RECENT POSTS

Categories

- Agriculture (33)

- Automobiles (19)

- Banking and Financial services (35)

- Consumer Markets (51)

- Defence (6)

- Ecommerce (21)

- Economy (69)

- Education (13)

- Engineering (6)

- Exports (21)

- Healthcare (25)

- India Inc. (8)

- Infrastructure (29)

- Manufacturing (28)

- Media and Entertainment (15)

- Micro, Small & Medium Enterprises (MSMEs) (15)

- Miscellaneous (30)

- Perspectives from India (34)

- Pharmaceuticals (4)

- Railways (4)

- Real Estate (17)

- Renewable Energy (18)

- Research and Development (9)

- Retail (1)

- Services (6)

- Startups (15)

- Technology (57)

- Textiles (8)

- Tourism (14)

- Trade (5)

How India is Becoming a Global Leader in Generic Injectables

- Oct 14, 2025, 10:25

- Pharmaceuticals

- IBEF

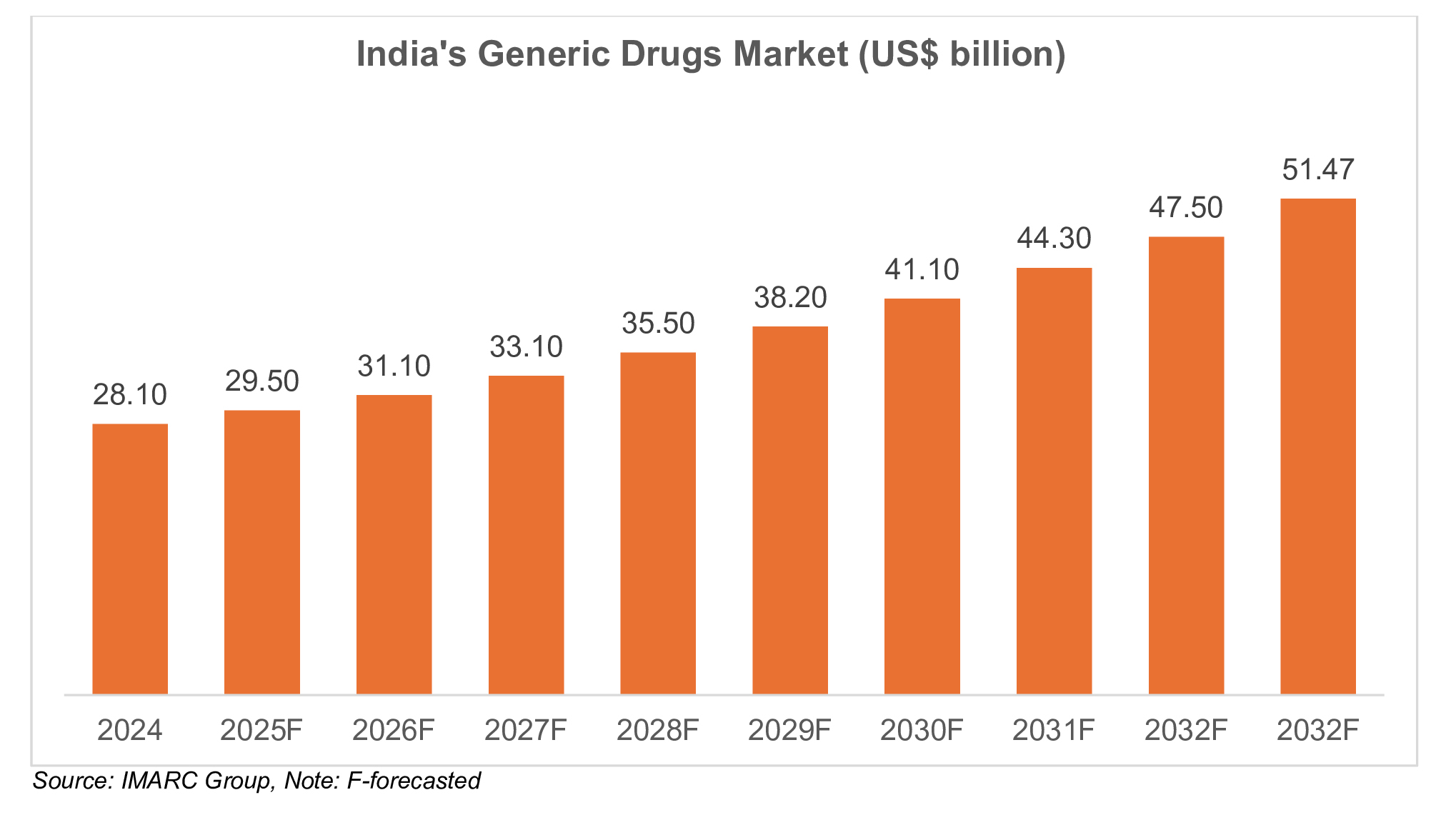

India is rapidly evolving into a global hub for generic injectable drugs, driven by rising cases of illnesses, cost-effective generation, and solid pharmaceutical exports. The generic injectable market in India was valued at Rs. 25,965 crore (US$ 3.0 billion) in 2024 and is anticipated to grow at a compound annual growth rate (CAGR) of 10.28% to reach Rs. 65,778 crore (US$ 7.6 billion) by 2033. The expanding demand for affordable medicines, particularly in emerging nations, is boosting India’s part as a leading provider of injectable drugs. With about 40% of generic drugs provided to the United States (US) originating from India, the country’s position as a global pioneer in generic injectables shows sustainable development supported by vigorous manufacturing, trade capabilities, and progressing healthcare needs.

Market dynamics and growth trajectory

Union Minister of Finance, Ms. Nirmala Sitharaman, highlighted that India’s pharmaceutical segment is gaining global importance. Valued at Rs. 4.29 lakh crore (US$ 50 billion), India is presently positioned as the third-largest pharmaceutical market across the board by volume. Broadly perceived as the “pharmacy of the world,” India supplies around 60,000 generic brands across 60 restorative categories and produces one in five generic drugs sent worldwide. Eight of the world’s top 20 generic pharmaceutical companies by revenue collectively generating over Rs. 1,73,500 crore (US$ 20 billion) are headquartered in India, underscoring the country’s pivotal role in the global generics market

The industry is encountering a vital boost due to the heightening advancement and generation of generic injectables. A few variables, including the developing emphasis on cost-effectiveness in healthcare, compel this surge. Generic injectables, being more affordable than their branded partners, offer an alluring arrangement for healthcare frameworks pointing to oversee costs without compromising quality. India’s generic injectable market is altogether extending.

India’s global footprint in injectables

India has established itself as a worldwide leader in generic injectables, with over 670 US FDA-approved offices and numerous practicing in sterile injectable creation. The nation contributes to the global generic injectable domain by providing an expansive share of injectable drugs to heavily regulated geographies such as the US, European Union (EU) and United Kingdom. In FY25, India’s drugs and pharmaceutical exports almost doublet and stood at US$ 30.3 billion as compared to US$ 17.2 billion in FY18, driven by solid demand for generic injectable drugs. Perceived as the pharmacy of the world, India plays a significant part in meeting global needs for generic injection, backed by innovative generation and a vigorous manufacturing base. Leading Indian companies are presently driving development and growth in India’s generic injectables sector, encouraging and reinforcing the country’s position as a key player in the global pharmaceutical supply chain. This development reflects India's significant part in making medications more available and affordable to individuals around the world and contributing to worldwide healthcare.

Government support for injectable manufacturing in India

Indian government’s vital plans and activities are pointed at boosting domestic capabilities and lessening outside dependence. These programmes are planned to back India’s generic injectable market, improve production practises, and enhance worldwide competitiveness of Indian pharmaceutical injectables.

One of the most impactful programmes is the Production Linked Incentive (PLI) Scheme, propelled to incentivise funding in manufacturing bulk drugs, including generic injectables. Under this scheme, qualified firms involved in the generation of injectable drugs receive budgetary incentives based on incremental deals. Initially approved in 2020–2021, with a cost of Rs. 6,940 crore (US$ 802 million) for the period 2022–23 to 2028–29, the scheme received a re-established thrust in May 2025 through a new circular of applications for 11 key Active Pharmaceutical Ingredients (APIs) and drug intermediates.

This move has empowered Indian sterile injectable producers to grow capacity, become more innovative, and strengthen reverse integration. Complementary activities like Jan Aushadhi (Pradhan Mantri Bhartiya Janaushadhi Pariyojana) aim to upgrade the availability of affordable, quality‑assured medicines, including generic injectable drugs over India, supporting domestic utilisation while settling demand for Indian pharmaceutical injectables. Further, the government’s National Policy on Research and Development and Innovation in the Pharma‑MedTech division advances headways in drug delivery frameworks and complex injectables, guaranteeing that India proceeds to lead the global generic injectable supply chain.

Industry-led innovation in India’s generic injectables market

The domestic industry, driven by huge pharmaceutical firms and rising players, has played a key part in scaling up capacity, progressing research and development, and boosting access to quality generic injectable drugs. Major players in India’s generic injectable domain include Sun Pharmaceutical, Cipla, Dr. Reddy’s Laboratories, Lupin, Aurobindo Pharma, and Zydus Lifesciences. These companies are intensely contributing to high-tech pharmaceutical plants to meet domestic demand and global export requirements. These leading Indian companies in injectable generics are not only addressing the developing demand for injectable drugs in India but also are growing their presence in directed markets such as the US and EU.

While India’s generic injectable drugs industry relentlessly grows as a world leader, it faces few noteworthy challenges such as incorporating high manufacturing costs, complex administrative compliance particularly with bodies such as the US Food and Drug Administration (FDA) and European Medicines Agency (EMA), heavy dependence on imported APIs, and the requirement for a robust cold chain framework. While keeping up with sterility guidelines and driven by the requirement for advancement and cost-efficiency, private firms are moving into complex and specialised generic injectables, including depot injectables, long-acting injectables, liposomal delivery frameworks, and biosimilars. Leading Indian firms such as Dr. Reddy’s, Sun Pharma, and Cipla have introduced advanced injectable formats such as long‑acting therapies, nanoparticle-based carriers, biosimilars like insulin and monoclonal antibodies, and self-administered options like prefilled syringes and auto-injectors boosting patient convenience and compliance. This reflects a move from conventional generics to high-value, low-competition items, further assisting India’s part in generic injectable market growth.

India’s path forward in generic injectables

Looking ahead, India’s position in the worldwide generic injectable supply chain is about to develop stronger. With supported investments in research and development, extension into generic injectable composition, and a focus on administrative compliance, Indian pharmaceutical firms are well-equipped to meet the growing demand for affordable, high-quality injectable drugs globally. Government-backed activities such as the Production Linked Incentive (PLI) scheme and development of pharma parks are quickening capacity-building endeavours, whereas private players are cultivating advancement through vital collaborations and framework upgrades.

As the world proceeds to look for cost-effective healthcare arrangements, India’s vigorous environment of sterile injectable manufacturers, advancing generic injectable market, and its commitment to quality and scalability will keep India at the forefront. With a mix of policy support, innovative headway, and industry-driven energy, India is not only addressing to worldwide wellbeing needs but is also redefining the future of generic injectable drugs.

FAQs

How is India emerging as a global leader in generic injectables?

India is rapidly becoming a global leader in generic injectables, thanks to robust manufacturing infrastructure, low-cost production, and high export capacity. With over 670 US FDA-approved facilities and major players like Sun Pharma, Cipla, and Dr. Reddy’s, India dominates the global generic injectable supply, especially to regulated markets like the US and EU.

What is the size of the generic injectable market in India?

The Generic injectable market in India was valued at Rs. 25,965 crore (US$ 3.0 billion) in 2024 and is projected to grow at a CAGR of 10.28%, reaching Rs. 65,778 crore (US$ 7.6 billion) by 2033. This growth is driven by rising global demand for affordable injectable drugs.

Why are Indian pharmaceutical injectables gaining global demand?

Indian pharmaceutical injectables are in demand due to their cost-effectiveness, quality compliance, and large-scale availability. India supplies around 40% of injectable generics to the US, showcasing its strength in injectable drug exports.

What support is the Indian government providing to boost injectable manufacturing?

The Government support for injectable manufacturing in India includes initiatives like the Production Linked Incentive (PLI) Scheme and Jan Aushadhi, which promote domestic production, R&D, and Indian sterile injectable manufacturers.

Who are the leading Indian companies in injectable generics?

Leading Indian companies in injectable generics include Sun Pharma, Cipla, Dr. Reddy’s, Aurobindo Pharma, Zydus Lifesciences, and Lupin, all playing a crucial role in India’s role in generic injectable market growth.