SEARCH

RECENT POSTS

Categories

- Agriculture (33)

- Automobiles (19)

- Banking and Financial services (35)

- Consumer Markets (51)

- Defence (6)

- Ecommerce (21)

- Economy (69)

- Education (13)

- Engineering (6)

- Exports (21)

- Healthcare (25)

- India Inc. (8)

- Infrastructure (29)

- Manufacturing (28)

- Media and Entertainment (15)

- Micro, Small & Medium Enterprises (MSMEs) (15)

- Miscellaneous (30)

- Perspectives from India (34)

- Pharmaceuticals (4)

- Railways (4)

- Real Estate (17)

- Renewable Energy (18)

- Research and Development (9)

- Retail (1)

- Services (6)

- Startups (15)

- Technology (57)

- Textiles (8)

- Tourism (14)

- Trade (5)

Exploring India’s Rare Earth Elements Industry: Potential and Global Impact

- Sep 16, 2025, 11:05

- Research and Development

- IBEF

India is undergoing a global transition in technology and energy with determination. In an era defined by rapid technological evolution and sustainable growth, rare earth elements (REEs) have emerged as critical minerals. These 17 elements (the 15 lanthanides plus scandium and yttrium) underpin over 200 advanced applications. India’s vision of self-reliance fuelled by pandemic-era supply disruptions has placed REEs at the heart of its economic and security strategy. The country is working proactively to reduce import dependence and harness its own resources for sectors ranging from electronics and clean energy to defence.

Understanding rare earth elements

Rare earth elements are the “vitamins” of modern industry. Despite their name and small share in devices, they possess unique magnetic, catalytic, and phosphorescent properties that are indispensable to innovative technology. For example, neodymium enables powerful magnets in electric motors, and europium is essential for the vibrant colours of screens. These properties cannot be easily substituted, making REEs critical even in minute quantities. They appear in everything from smartphones and laptops to wind turbines, electric vehicles, drones, and precision defence systems. Without REEs, the productions of many high-tech, green, and even medical innovations would be severely constrained.

Mining these elements is technically complex. REEs are not truly scarce. However, concentrated, economically viable deposits are rare especially for heavy rare earths.

Global dynamics and India’s position

For decades, China has dominated the global rare earths market. By the early 2000s it produced over 95% of the world’s supply, leveraging low costs and loose environmental rules.

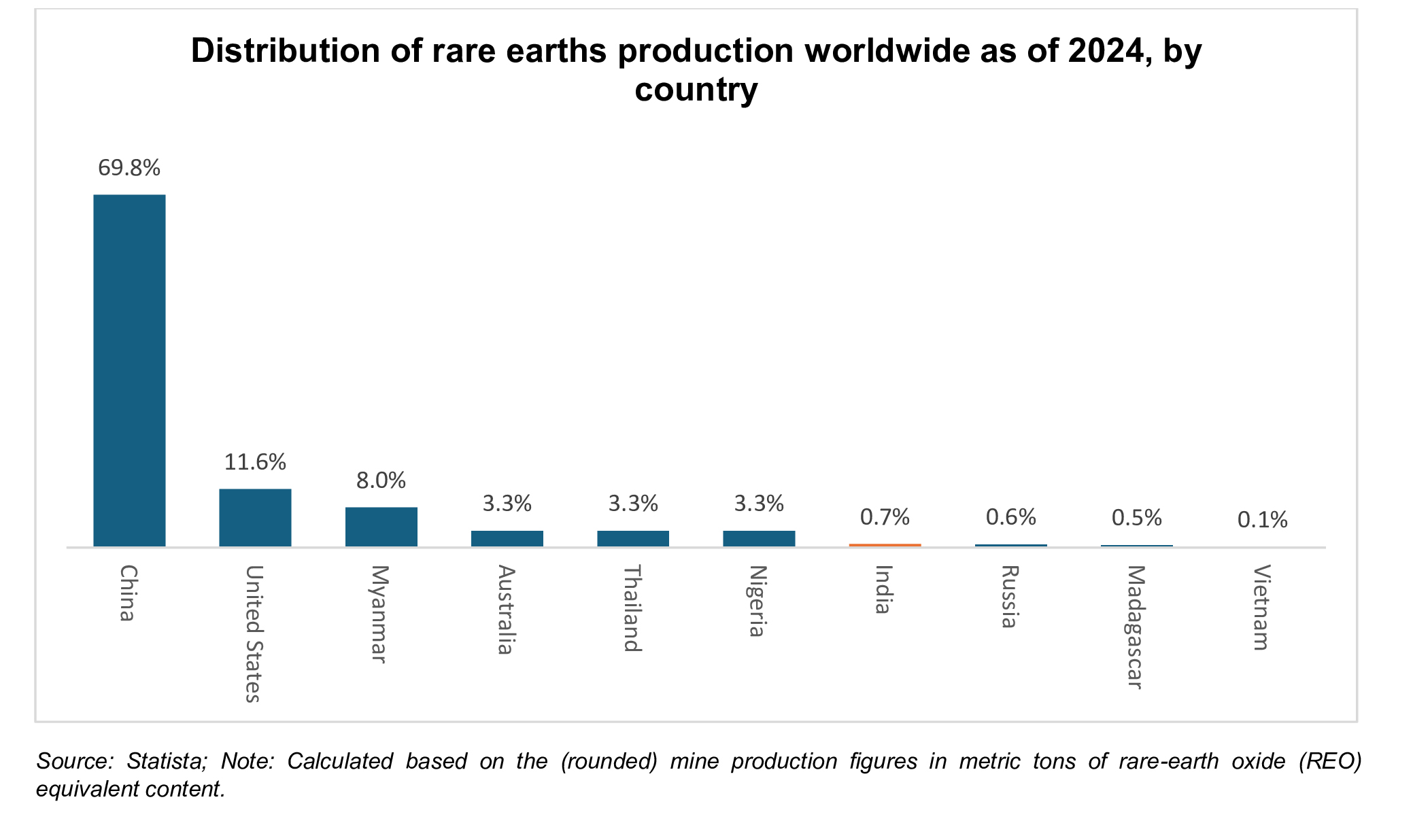

Today, China still controls ~70% of global output. The United States (US) and Myanmar each account for ~12–8%, with Australia, Thailand, Nigeria, and others sharing the remainder. India’s own output is currently a small slice about 0.7% of the world’s supply as of 2024.

Geopolitical tensions and the clean energy transition are encouraging the diversification of supply chains from China. Globally, the production of rare earth oxides since 2017 have almost tripled, with production closing toward 3,90,000 metric tons in 2024.

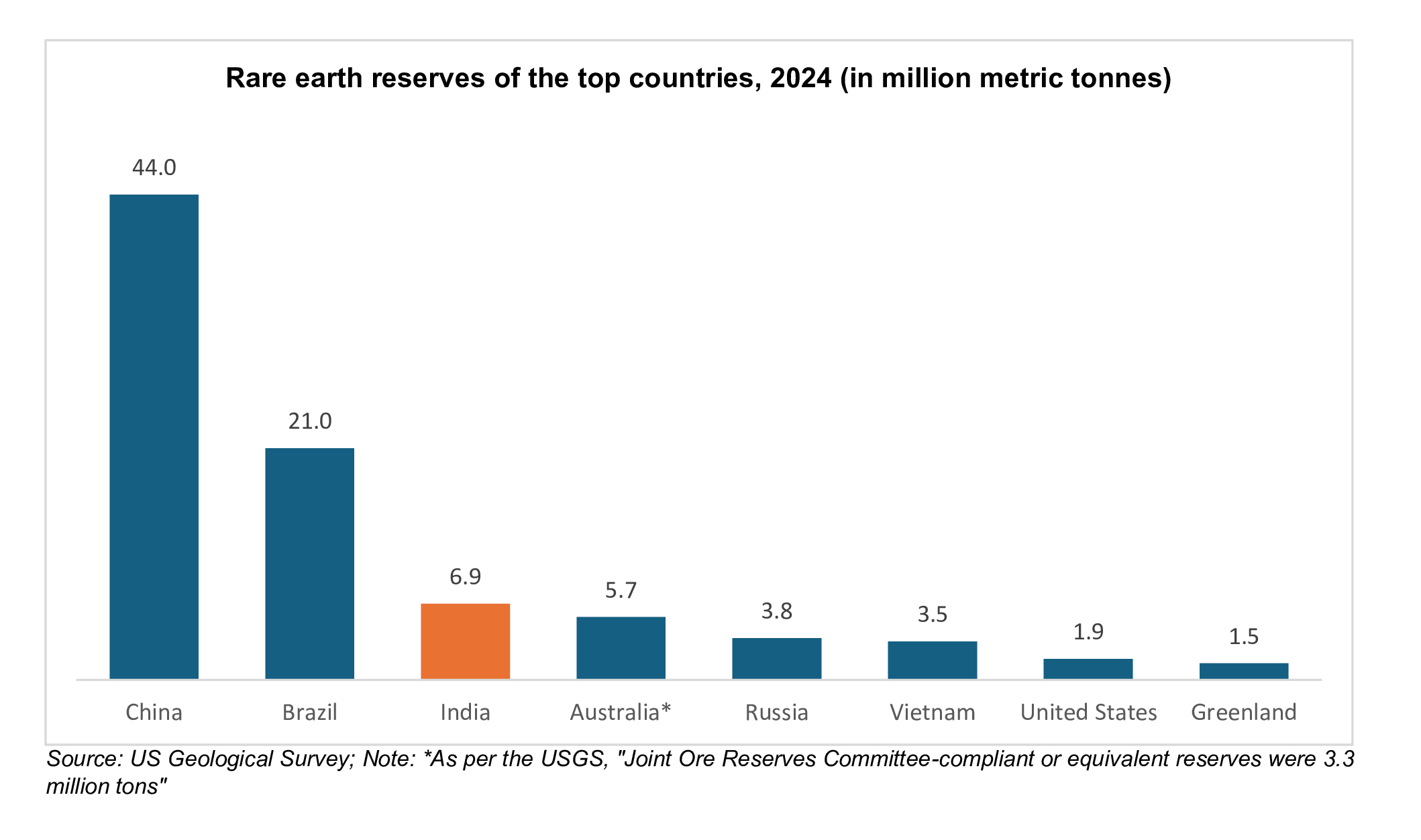

Global rare earth reserves (top eight countries, 2024)

Top reserve holders signal where the future may lie: China, Brazil, and India are reported to have the largest reserve bases, followed by Australia, Russia, Vietnam, the U.S., and Greenland.

India is believed to hold ~6.9 million metric tons of rare earth reserves, making it the world’s third largest reserve holder. This vast resource, if fully tapped, could position India as a key long-term supplier.

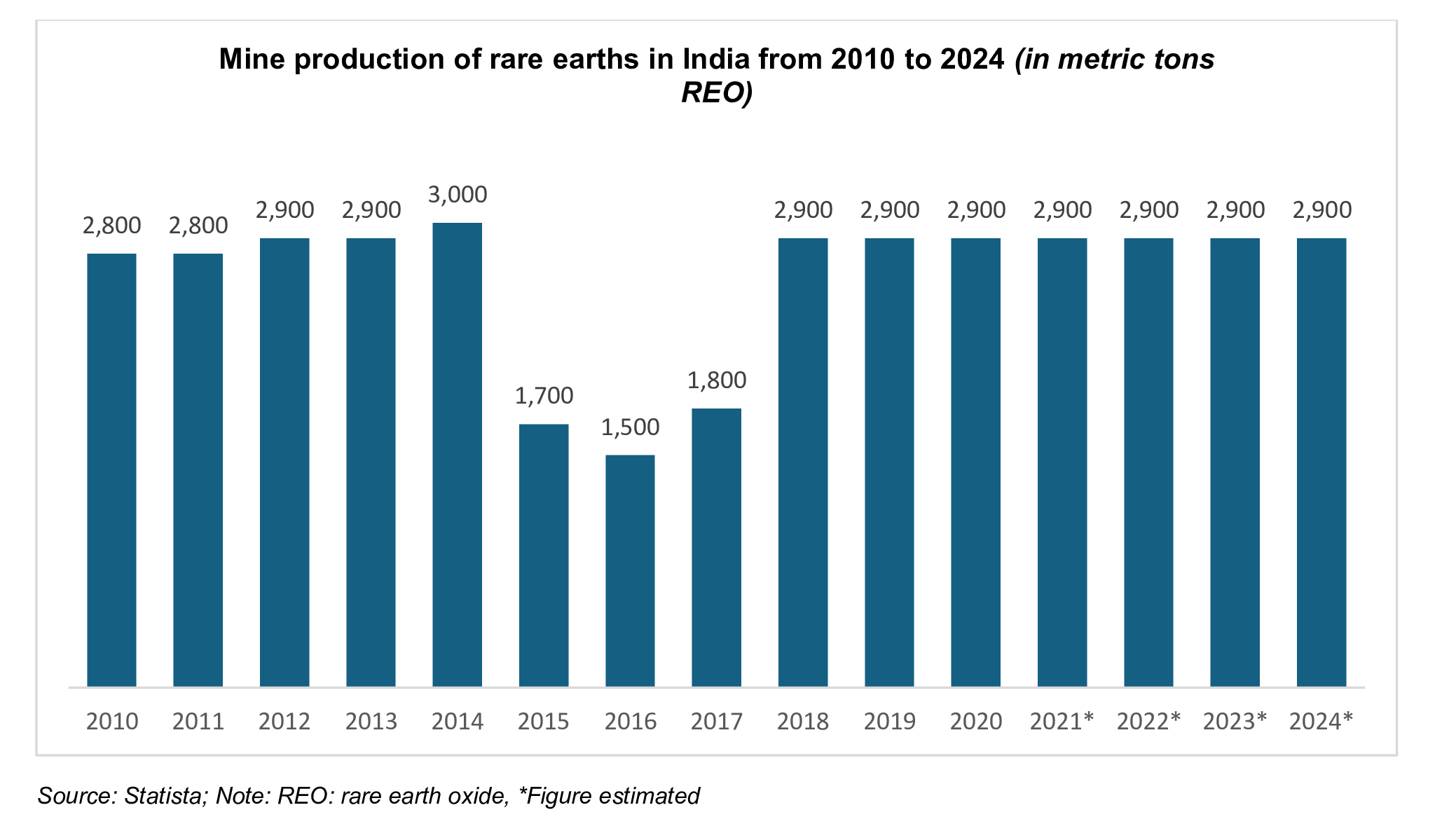

Mine production of rare earths in India from 2010 to 2024

Despite this potential, India’s actual production has remained modest. Mine output is ~2,900 metric tons per year and has seen little growth. This is less than 1% of the global supply, a striking gap given that India possesses an estimated 35% of the world’s beach sand mineral deposits (a rich source of rare earths). Realising this potential requires bridging the gap between reserves and production.

Government initiatives

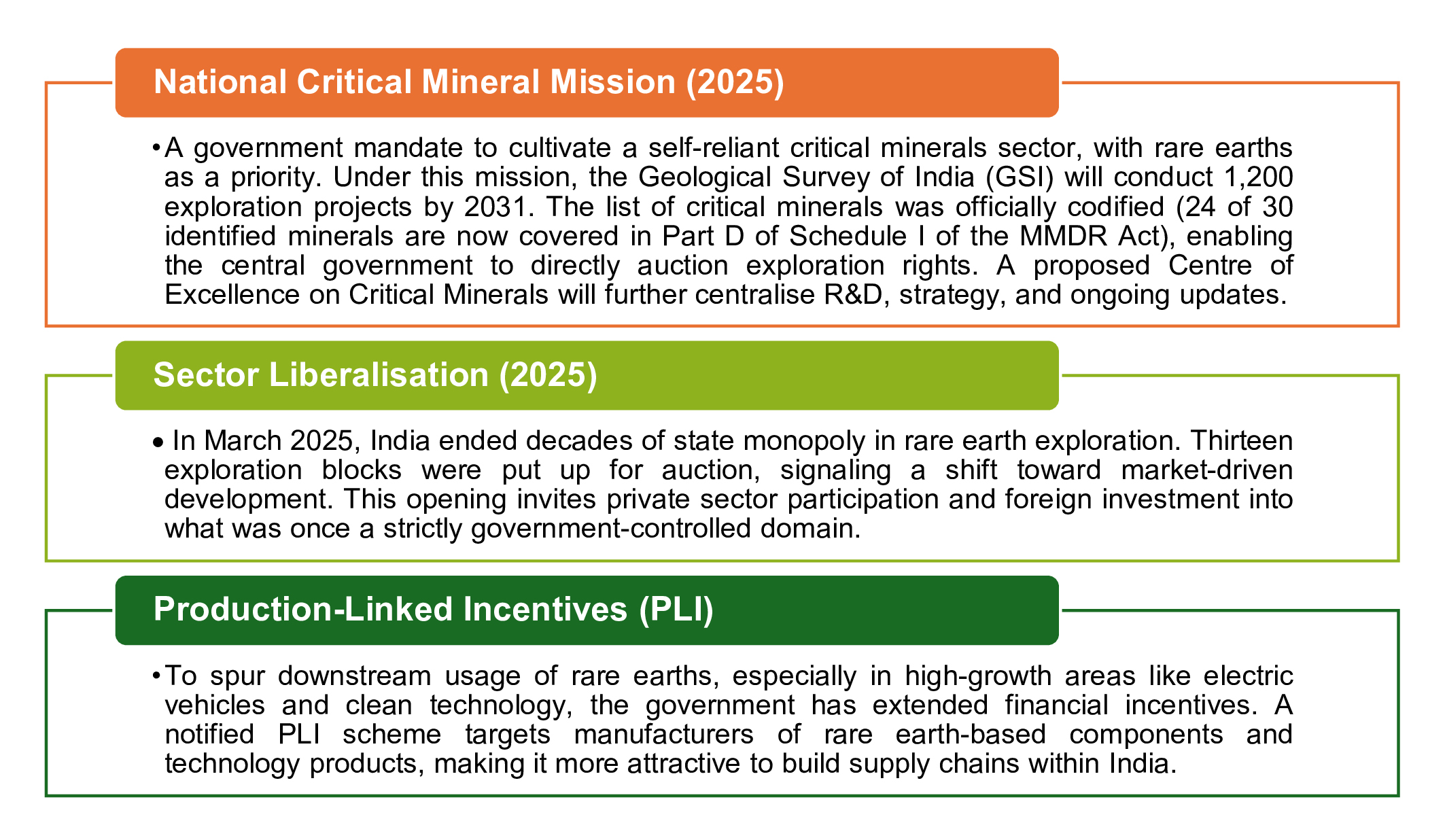

Recognising rare earths as strategic assets, the government launched initiatives to develop the sector. These efforts blend policy reform, funding incentives, and infrastructure projects to create a robust domestic rare earth ecosystem. Key initiatives include:

Alongside these, major projects are underway:

- The Rare Earth Theme Park Initiative will establish pilot plants and demonstration facilities across the value chain, fostering entrepreneurship and skills development.

- Odisha Sands Complex (OSCOM) a flagship unit of Indian Rare Earths Limited (IREL) is expanding its processing capacity (notably for mixed rare earth chlorides) and upgrading its mineral handling infrastructure (including a private freight terminal and a new de-salination plant). A planned Rare Earth Permanent Magnet plant will produce 3,000 kilograms of magnets for defence and clean energy applications. Joint ventures, such as IREL-IDCOL, are building new mining and separation plants to mine coastal sand deposits in Odisha.

- In Bhopal, a proposed Rare Earth and Titanium Theme Park aims to commercialise laboratory-scale technologies for extraction and processing, creating an innovation hub for the sector.

Industrial capability and future capacity

India already has a historical foundation in rare earth processing. IREL, established in 1950, has decades of experience in refining and metallurgy. Building on this, the government aims to triple the country’s rare earth oxide production capacity by 2032 to meet growing industrial and export demand.

Private industry is also stepping up: In late 2024, Trafalgar Engineering announced plans for India’s first integrated plant to produce rare earth metals, alloys, and magnets. Such facilities would fill a critical gap in the value chain, allowing India to go beyond the mining of raw materials and proceed up the value chain toward the production of finished, high-technology goods.

These all feed into a combined effort to form a 100% domestic supply chain, from exploration and mining to processing and the end-use manufacturing process.

Strategic importance for India’s future

India’s push into rare earths is closely tied to broader national goals. Rare earth elements are key enablers in four strategic arenas:

- Clean energy and decarbonisation: REEs are essential for renewable energy technologies – from the powerful magnets in wind turbines to catalysts in solar panels and batteries in electric vehicles. Expanding domestic rare earth capacity supports India’s climate targets and energy security by nurturing a local clean-tech industry.

- Advanced electronics and mobility: As India furthers the digital economy and manufacturing of electronics (smartphones, computers, and consumer electronics), access to rare earths provides supply security. It is also the foundation for the development of electric and autonomous vehicles, drones, and other new transportation.

- National security and defence: Defence systems – guided missiles, radar, lasers, communication systems – depend extensively on REE based parts. Domestic production of rare earths will enhance national security by lowering India’s geopolitical risk exposure to supply shocks.

- Economic growth and export potential: In producing rare earths domestically, not only can India save on expensive rare-earth imports (which can lead to trade surplus in critical minerals) but could also create/ export high value materials. This follows a broader “Make in India” vision and diversifies the industrial base.

In short, developing rare earth resources gives India an economic edge and underscores its long-term strategic vision.

India’s rare earths odyssey is at an inflection point. With ample reserves, a growing global demand and strong policy support, India has what it takes to become a strong player in the world regarding rare earth elements. The government’s sweeping reforms and incentives are a sign of its determination to turn mineral wealth into national power.

The challenges in technology and regulation will be demanding, but India’s long-term perspective is evident — to translate its rare earth possibilities into economic growth, technological leadership, and strategic security.

As the world moves toward a networked, greener, technology-fuelled future, India’s development of these industries could build the foundations of its economic and geopolitical rise.