RECENT CASE STUDIES

India's Gems and Jewellery Sector Going Global

Last updated: Aug, 2024

India’s gems and jewellery (G&J) sector is an indispensable part of its culture and economy and has contributed immensely to enhancing the nation’s progress. This sector is famous globally for excellent craftmanship and bright traditions, thus becoming a major sustainer of the people’s living standards and the booster of India’s exports movement. The Indian G&J sector has the potential to succeed in international markets due to the availability of skilled workers, innovative designing approach and support from government policies. However, there are challenges like volatile market demands, enhanced governmental regulations, and more importantly it becomes challenging to find reliable suppliers for raw materials in this sector. This paper presents an analysis of trends that prevail in the G&J sector and the strategies that firms in this sector use to export successfully in the global markets.

Market analysis and export trend

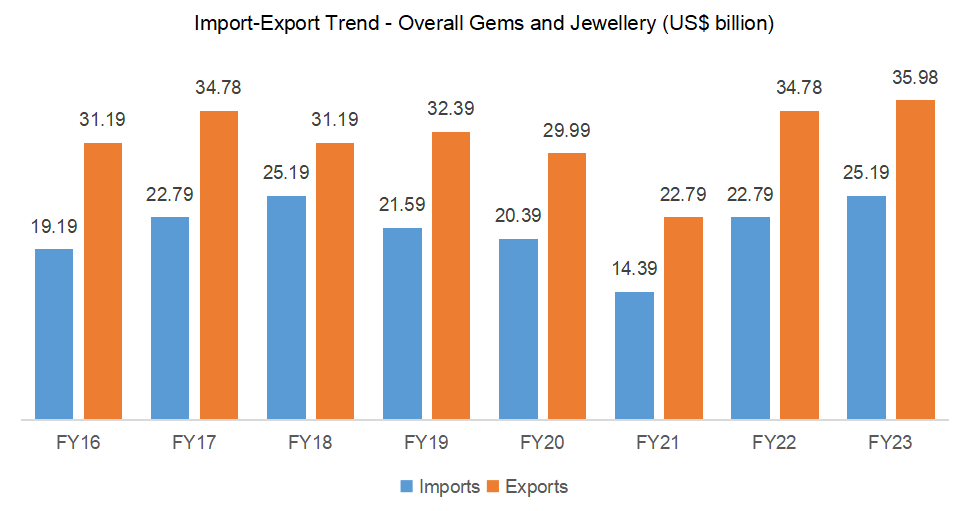

Rising exports of gems and jewellery displaying the global expansion trend

Source: Gems & Jewellery Export Promotion Council (GJEPC)

The gems and jewellery sector accounts for 9% of India’s total exports, amounting to Rs. 3 trillion (US$ 35.98 billion) in FY23. Meanwhile, gems and jewellery imports into the country accounted for 4% of total imports, amounting to Rs. 2.1 trillion (US$ 25.19 billion) in FY23.

According to GJEPC, India held a share of 4.3% in the world’s gems and jewellery exports in 2022 and was positioned as the sixth largest exporter of gems and jewellery worldwide in that year. The sector contributes ~7% to the country’s Gross Domestic Product (GDP). In terms of employment, it engages more than five million workers in the country. By contributing 10-12% of the total merchandise exports, India’s gems and jewellery sector holds the third largest commodity share.

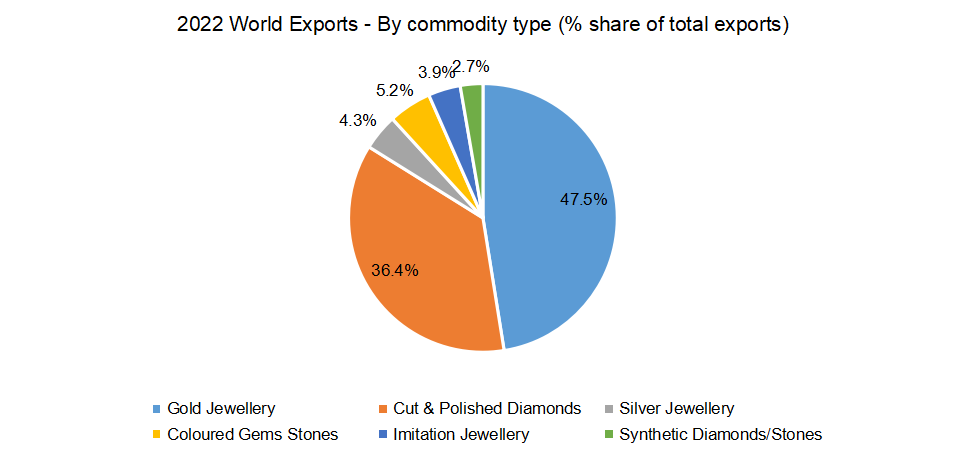

Gold Jewellery and Cut & Polished Diamonds hold majority of the share of the total G&J world exports.

Source: Gems & Jewellery Export Promotion Council (GJEPC)

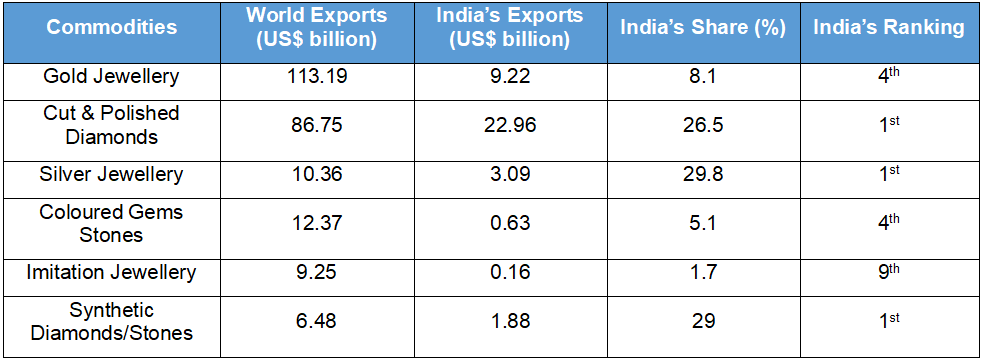

India’s continued dominance in most gems and jewellery segments (2022)

Source: Gems & Jewellery Export Promotion Council (GJEPC)

In 2022, India exported US$ 9.22 billion worth of gold jewellery, accounting for 8.1% of the world’s total gold jewellery exports. The country stood fourth in terms of gold jewellery exports. With regards to cut and polished diamonds, the country exported US$ 22.96 billion worth of diamonds, with a share of 26.5% and ranked first as the largest exporter. In terms of silver jewellery, India exported US$ 3.09 billion worth of silver jewellery, with a share of 29.8% and ranked first as the largest exporter. Synthetic diamonds/stones have been gaining traction in recent years. In 2022, India held a share of 29% of total exports of synthetic diamonds/stones exports worldwide and was ranked the largest exporter.

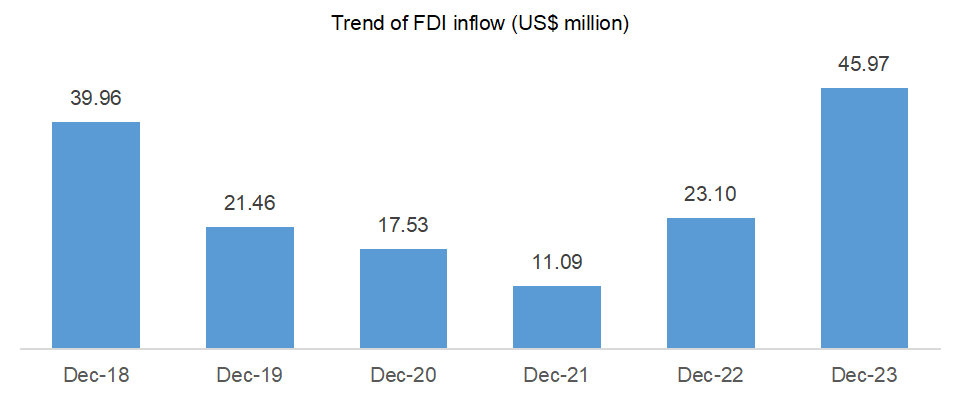

Foreign Direct Inflow (FDI) in India’s gems and jewellery sector

Source: DPIIT website

There has been a notable and consistent upward trend in the flow of FDI from December 2021 to December 2023. Total FDI attracted in the gems and jewellery sector from April 2000 to December 2023 has been estimated at US$ 1.27 billion (0.19% of total FDI inflow). The gems & jewellery exports are second most important Foreign Exchange Earner (FEE) in the Indian economy. India has emerged as the centre of jewellery manufacturing due to certain factors such as inexpensive labour and low-cost production and other factors such as favourable government policies. The sector is completely open for manual investment through 100% FDI through the automatic route.

There are several measures that the Indian government has undertaken to boost investments as well as to upgrade technologies. The country is now aspiring to create a ‘Brand India’ in the international market due to its potential for growth. This decision of the Government of India to allow the FDI in the retail market also paved the way for growth in the organised jewellery sector. It opened up opportunities for millions of people creating jobs in sectors such as logistics department, centres for repacking, distribution networks, cleansing services, securities, etc. FDI has been one of the most influencing factors for growth of the jewellery sector and plays a very significant role in the development of the economy.

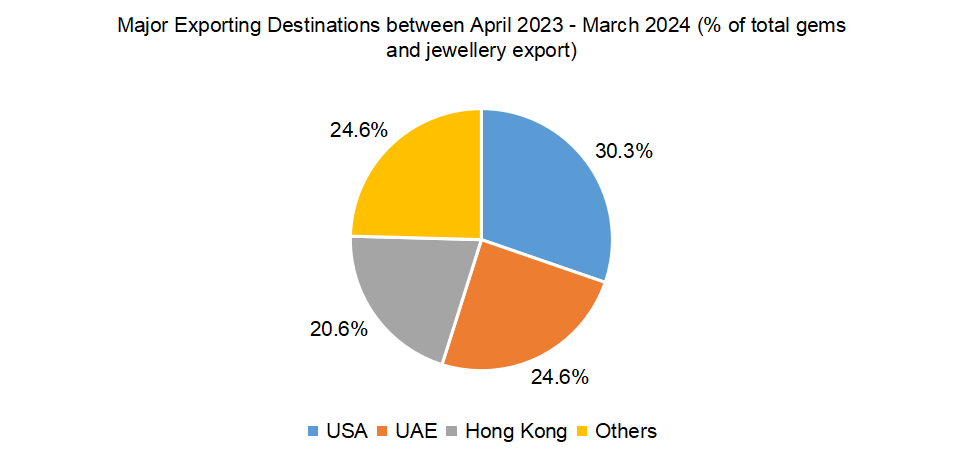

The main export destinations for gems and jewellery from India include the United States, United Arab Emirates, Hong Kong, Belgium, Israel, Thailand, Singapore, United Kingdom, and Switzerland, among others. With a 30.29% share (US$ 9.90 billion in value), the US is the largest importer of all jewellery and gems exported from India between April 2023 and March 2024. The United Arab Emirates accounted for 24.57% of the gems and jewellery exported from India, amounting to US$ 8.03 billion in value. Hong Kong’s share in total exports of gems and jewellery from India was 20.57% with a value of US$ 6.72 billion.

USA, UAE, and Hong Kong were the top 3 destinations for export of gems and jewellery from India

Source: NIRYAT website

In 2021-22, export destinations such as the UK, the Netherlands, Thailand, and Israel registered faster growth of more than 55% in the gems and jewellery imported from India than in the pre-pandemic year of 2019-20. This general upswing has been attributed to the revival of consumer spending to pre-Covid-19 levels as well as the expansion of new retail stores after the abolishment of Covid restrictions. Going forward, the development of India Jewellery Exposition (IJEX) centre at Dubai and various MOUs signed with different export zones, including the UAE, Israel, UK, Canada, and Australia, should be a vital export thrust in the near future.

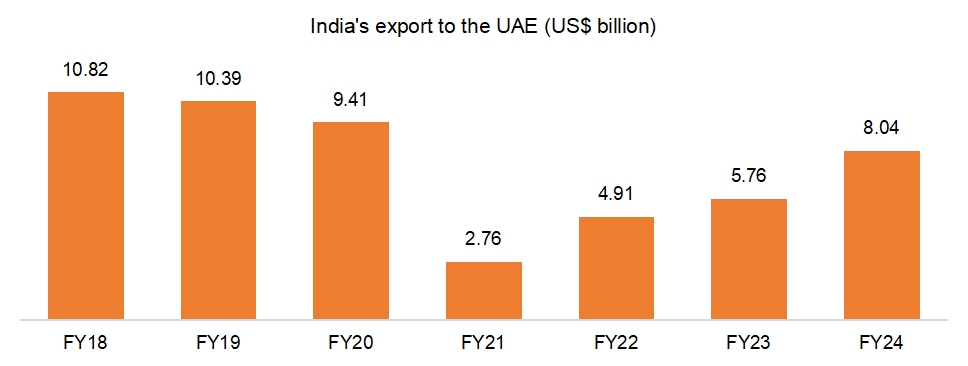

UAE market has been one of the major drivers of the surge India’s gems and jewellery exports

Source: NIRYAT website

Currently the UAE market takes around 25% of the gems and jewellery exported from India. This has been one of the drivers that greatly contributed to India’s increased export market in the recent past. The country’s gems and jewellery exports to the UAE stands at ~US$ 8 billion in FY24, showcasing a 31% Compound Annual Growth Rate (CAGR) from FY21. The increase in the UAE-India trade has been facilitated by the Comprehensive Economic Partnership Agreement (CEPA) signed in 2022. As per information from GJEPC, of the total gems and jewels imported into UAE, about 30% originates from India.

The current export value of US$ 8.04 billion to the UAE from India is still below the pre-pandemic peak of US$ 10.82 billion, indicating further upside potential from the FY24 level of $8.04 billion in exports to the UAE.

Strategies adopted for international expansion

India’s G&J sector uses the following techniques to expand its export market. This includes various modes of market entry, strategies for marketing and branding, and learning from successful examples of Indian companies venturing into the global market.

- Enhancing Product Quality and Design

- Adopting International Standards: Increasing adherence to international standards for quality and certification, such as those set by the World Jewellery Confederation (CIBJO).

- Design Innovation: Emphasis on innovative and contemporary designs to cater to diverse global tastes and trends. Collaborations with international designers and participation in global design competitions are common.

- Technology Integration

- Advanced Manufacturing Techniques: Use of cutting-edge technologies such as Computer-Aided Design (CAD) and 3D printing to improve precision and reduce production time.

- Blockchain for Traceability: Implementing blockchain technology to ensure transparency and traceability in the supply chain, which helps in building trust with international buyers.

- Marketing and Branding

- Brand Building: Development of strong brands that resonate with global customers. Some Indian jewellery brands have established presence in global markets via strategic marketing campaigns.

- Participation in International Trade Shows: Active participation in global trade fairs and exhibitions like Baselworld, JCK Las Vegas, and Hong Kong International Jewellery Show to showcase Indian craftsmanship and network with international buyers.

- Strategic Alliances and Partnerships

- Joint Ventures and Collaborations: Forming joint ventures with international firms for better market penetration. Collaborations with global luxury brands to co-create products that appeal to a wider audience.

- Retail Expansion: Opening retail outlets in key international markets and forming strategic alliances with established retailers to enhance distribution networks.

- Export Promotion Initiatives

- Government Support: Leveraging government initiatives such as the Merchandise Exports from India Scheme (MEIS) and support from the Gems and Jewellery Export Promotion Council (GJEPC) for market research, trade missions, and buyer-seller meets.

- Favorable Trade Agreements: Utilising Free Trade Agreements (FTAs) and bilateral trade agreements to reduce tariffs and gain easier market access.

- E-commerce and Digital Platforms

- Online Marketplaces: Increasing presence on global e-commerce platforms like Amazon, Alibaba, and specialised jewellery sites to reach a broader audience.

- Digital Marketing: Utilising digital marketing strategies, including social media campaigns, influencer partnerships, and online advertising to boost brand visibility and attract international customers.

Conclusion

The G&J sector of India has a profound history in the country’s culture. It has expanded itself to become a global market. Key achievements include the formation of the Gem and Jewellery Export Promotion Council (GJEPC) and the embracing of new technologies and Special Economic Zones (SEZs). Programmes like Make in India or treaties like the Comprehensive Economic Partnership Agreement with the UAE have further helped in exports and FDI. India holds a prominent position in the global diamond polishing industry and is among the top exporters of gold and synthetic stones. Ethical sourcing, sustainability and hallmarking have helped developed trust and quality standards for India’s products across the world. Some of the challenges include fluctuating consumer demands and increased regulatory requirements, but through digitalisation and e-commerce, the sector has continued to grow – more so after the Covid-19 outbreak. With skilled manpower, availability of resources and favourable policies, India can further increase globalisation in terms of this sector. Challenges in the G&J sector will be made easier by developing new solutions and sustaining its competitive advantage through technology and sustainability to ensure that India remains a dominant player in the global market.